Question: QUESTION 1 You are a Junior Associate working for a wealth fund in Australia. You are given a dataset in an Excel file by one

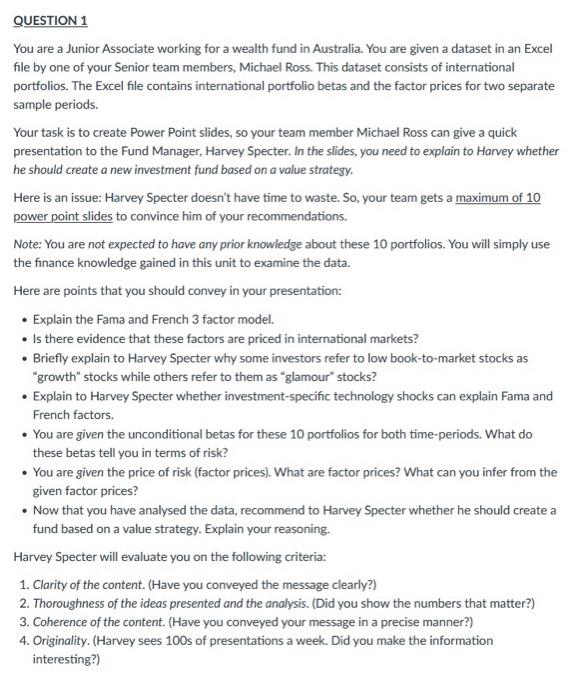

QUESTION 1 You are a Junior Associate working for a wealth fund in Australia. You are given a dataset in an Excel file by one of your Senior team members, Michael Ross. This dataset consists of international portfolios. The Excel file contains international portfolio betas and the factor prices for two separate sample periods. Your task is to create Power Point slides, so your team member Michael Ross can give a quick presentation to the Fund Manager, Harvey Specter. In the slides, you need to explain to Harvey whether he should create a new investment fund based on a value strategy. Here is an issue: Harvey Specter doesn't have time to waste. So, your team gets a maximum of 10 power point slides to convince him of your recommendations. Note: You are not expected to have any prior knowledge about these 10 portfolios. You will simply use the finance knowledge gained in this unit to examine the data. Here are points that you should convey in your presentation: - Explain the Fama and French 3 factor model. - Is there evidence that these factors are priced in international markets? - Briefly explain to Harvey Specter why some investors refer to low book-to-market stocks as "growth" stocks while others refer to them as "glamour" stocks? - Explain to Harvey Specter whether investment-specific technology shocks can explain Fama and French factors. - You are given the unconditional betas for these 10 portfolios for both time-periods. What do these betas tell you in terms of risk? - You are given the price of risk (factor prices). What are factor prices? What can you infer from the given factor prices? - Now that you have analysed the data, recommend to Harvey Specter whether he should create a fund based on a value strategy. Explain your reasoning. Harvey Specter will evaluate you on the following criteria: 1. Clarity of the content. (Have you conveyed the message clearly?) 2. Thoroughness of the ideas presented and the analysis. (Did you show the numbers that matter?) 3. Coherence of the content. (Have you conveyed your message in a precise manner?) 4. Originality. (Harvey sees 100 s of presentations a week. Did you make the information interesting?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts