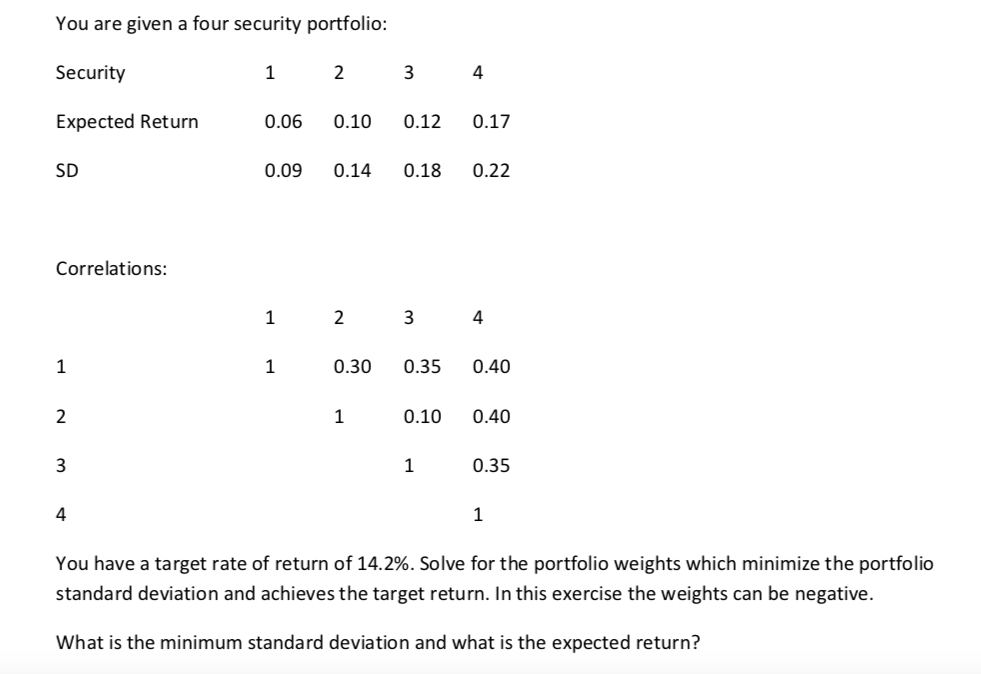

Question: You are given a four security portfolio: Security Expected Return SD 0.06 0.10 0.12 0.17 0.09 0.14 0.18 0.22 Correlations 1 0.30 0.35 0.40 1

You are given a four security portfolio: Security Expected Return SD 0.06 0.10 0.12 0.17 0.09 0.14 0.18 0.22 Correlations 1 0.30 0.35 0.40 1 0.10 0.40 1 0.35 4 You have a target rate of return of 14.2%. Solve for the portfolio weights which minimize the portfolio standard deviation and achieves the target return. In this exercise the weights can be negative. What is the minimum standard deviation and what is the expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts