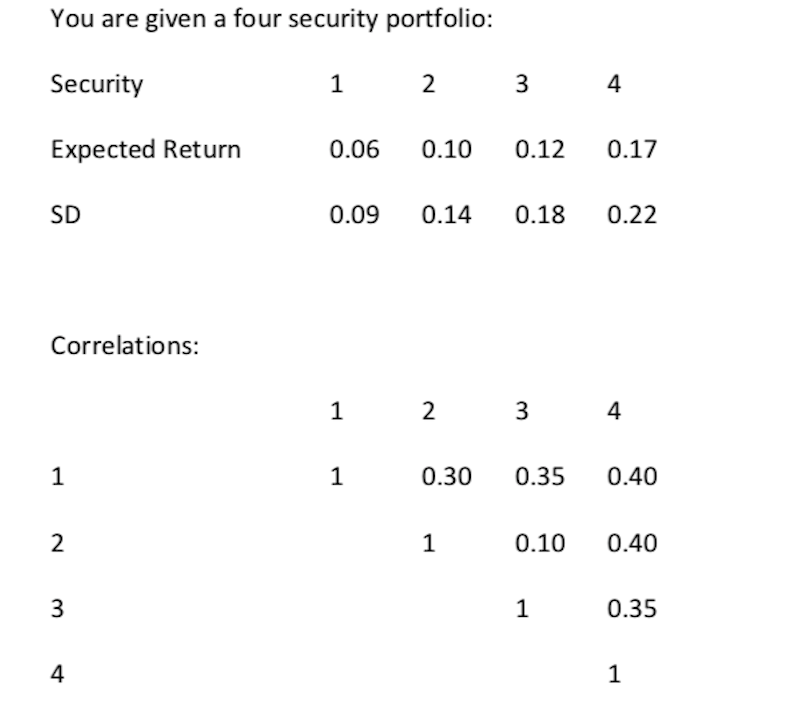

Question: You are given a four security portfolio: Security Expected Return SD 4 0.06 0.10 0.12 0.17 0.09 0.14 0.18 0.22 Correlations: 4 0.30 0.35 0.40

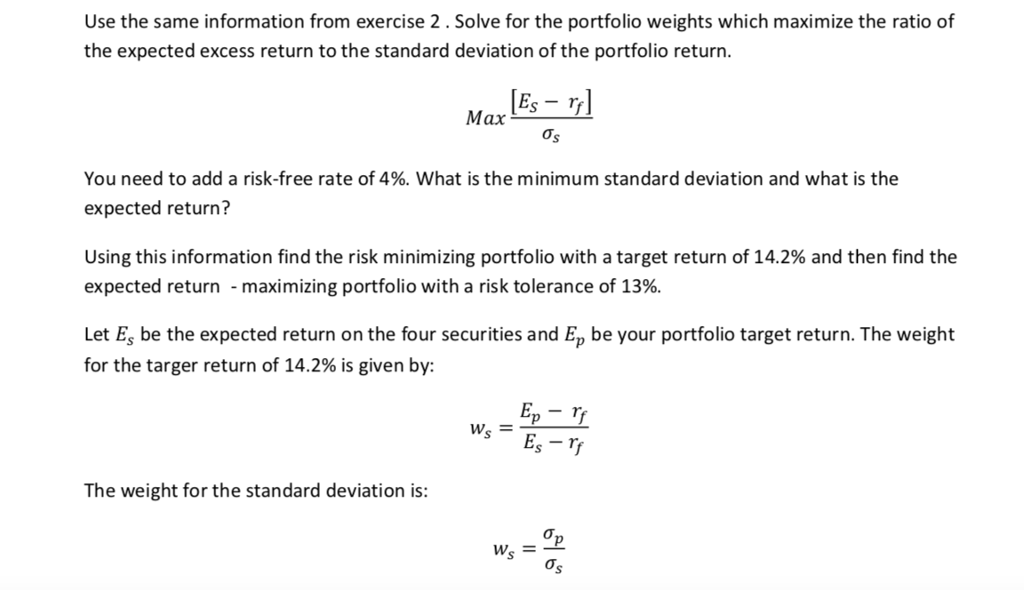

You are given a four security portfolio: Security Expected Return SD 4 0.06 0.10 0.12 0.17 0.09 0.14 0.18 0.22 Correlations: 4 0.30 0.35 0.40 0.10 0.40 0.35 4 Use the same information from exercise 2. Solve for the portfolio weights which maximize the ratio of the expected excess return to the standard deviation of the portfolio return. Max I&-! You need to add a risk-free rate of 4%, what is the minimum standard deviation and what is the expected return? Using this information find the risk minimizing portfolio with a target return of 14.2% and then find the expected return-maximizing portfolio with a risk tolerance of 13%. Let Es be the expected return on the four securities and Ep be your portfolio target return. The weight for the targer return of 14.2% is given by: Ep -Tr SEs T We = The weight for the standard deviation is: ws =- You are given a four security portfolio: Security Expected Return SD 4 0.06 0.10 0.12 0.17 0.09 0.14 0.18 0.22 Correlations: 4 0.30 0.35 0.40 0.10 0.40 0.35 4 Use the same information from exercise 2. Solve for the portfolio weights which maximize the ratio of the expected excess return to the standard deviation of the portfolio return. Max I&-! You need to add a risk-free rate of 4%, what is the minimum standard deviation and what is the expected return? Using this information find the risk minimizing portfolio with a target return of 14.2% and then find the expected return-maximizing portfolio with a risk tolerance of 13%. Let Es be the expected return on the four securities and Ep be your portfolio target return. The weight for the targer return of 14.2% is given by: Ep -Tr SEs T We = The weight for the standard deviation is: ws =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts