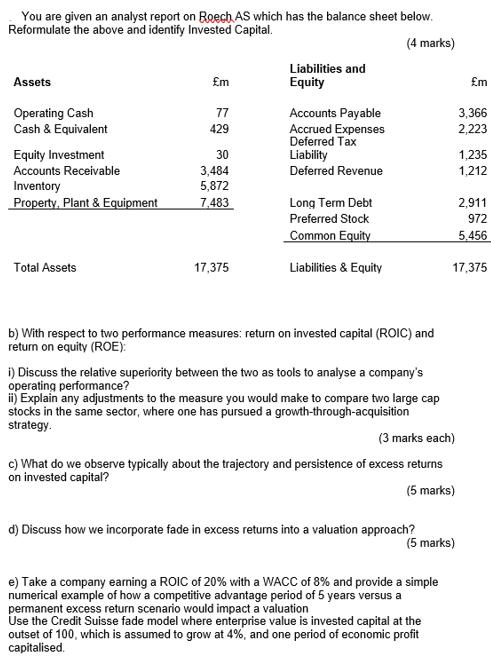

Question: You are given an analyst report on Roech AS which has the balance sheet below. Reformulate the above and identify Invested Capital. (4 marks)

You are given an analyst report on Roech AS which has the balance sheet below. Reformulate the above and identify Invested Capital. (4 marks) Assets Operating Cash Cash & Equivalent Equity Investment Accounts Receivable Inventory Property, Plant & Equipment Total Assets m 77 429 30 3,484 5,872 7,483 17,375 Liabilities and Equity Accounts Payable Accrued Expenses Deferred Tax Liability Deferred Revenue Long Term Debt Preferred Stock Common Equity Liabilities & Equity b) with respect to two performance measures: return on invested capital (ROIC) and return on equity (ROE): i) Discuss the relative superiority between the two as tools to analyse a company's operating performance? ii) Explain any adjustments to the measure you would make to compare two large cap stocks in the same sector, where one has pursued a growth-through-acquisition strategy. (3 marks each) c) What do we observe typically about the trajectory and persistence of excess returns on invested capital? (5 marks) d) Discuss how we incorporate fade in excess returns into a valuation approach? (5 marks) e) Take a company earning a ROIC of 20% with a WACC of 8% and provide a simple numerical example of how a competitive advantage period of 5 years versus a permanent excess return scenario would impact a valuation Use the Credit Suisse fade model where enterprise value is invested capital at the outset of 100, which is assumed to grow at 4%, and one period of economic profit capitalised. m 3,366 2,223 1,235 1,212 2,911 972 17,375 5,456

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts