Question: You are given the following data about expected returns on a Bank security on the LUSE where different states of the economy have the

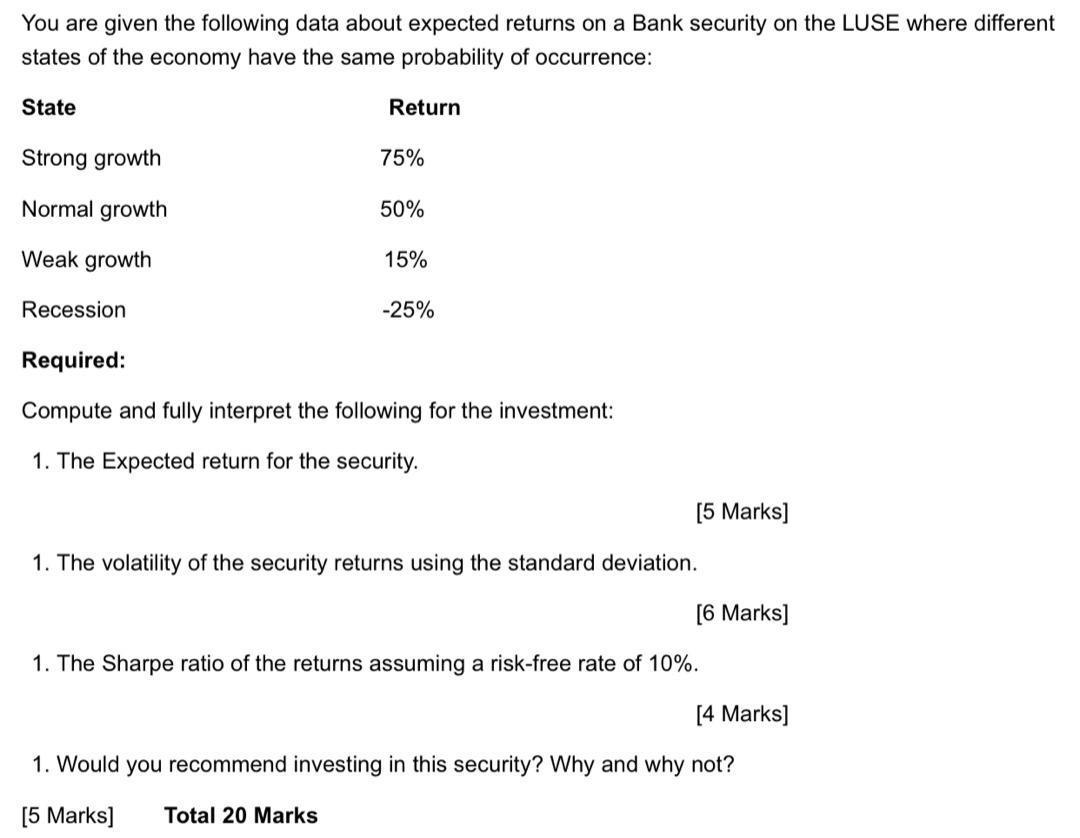

You are given the following data about expected returns on a Bank security on the LUSE where different states of the economy have the same probability of occurrence: State Return Strong growth 75% Normal growth 50% Weak growth 15% Recession -25% Required: Compute and fully interpret the following for the investment: 1. The Expected return for the security. 1. The volatility of the security returns using the standard deviation. [5 Marks] [6 Marks] 1. The Sharpe ratio of the returns assuming a risk-free rate of 10%. [4 Marks] 1. Would you recommend investing in this security? Why and why not? [5 Marks] Total 20 Marks

Step by Step Solution

3.27 Rating (150 Votes )

There are 3 Steps involved in it

To calculate the expected return for the security we need to multiply the return in each state of the economy by its respective probability and sum th... View full answer

Get step-by-step solutions from verified subject matter experts