Question: You are given the following information about the current state of the continu- ously compounded zero yield curve, and four possible scenarios that might

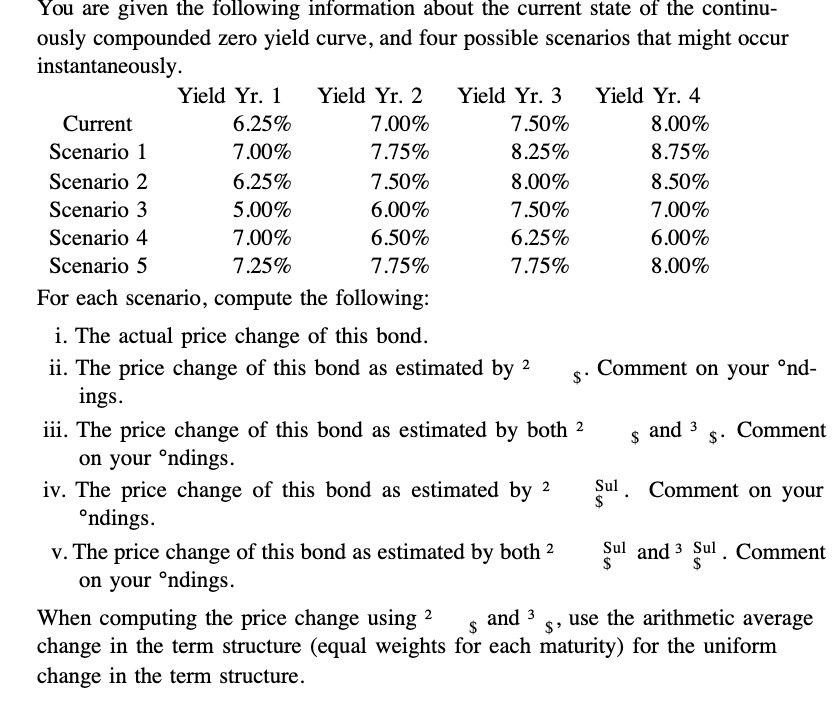

You are given the following information about the current state of the continu- ously compounded zero yield curve, and four possible scenarios that might occur instantaneously. Yield Yr. 1 Yield Yr. 2 Yield Yr. 3 Yield Yr. 4 Current 6.25% 7.00% 7.50% 8.00% Scenario 1 7.00% 7.75% 8.25% 8.75% Scenario 2 6.25% 7.50% 8.00% 8.50% Scenario 3 5.00% 6.00% 7.50% 7.00% Scenario 4 7.00% 6.50% 6.25% 6.00% Scenario 5 7.25% 7.75% 7.75% 8.00% For each scenario, compute the following: i. The actual price change of this bond. ii. The price change of this bond as estimated by 2 ings. $' iii. The price change of this bond as estimated by both 2 on your ndings. iv. The price change of this bond as estimated by 2 ndings. v. The price change of this bond as estimated by both 2 on your ndings. When computing the price change using 2 $ and 3 $' Comment on your nd- $ and 3 $. Comment Sul. Comment on your $ Sul and 3 Sul. Comment $ use the arithmetic average change in the term structure (equal weights for each maturity) for the uniform change in the term structure.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts