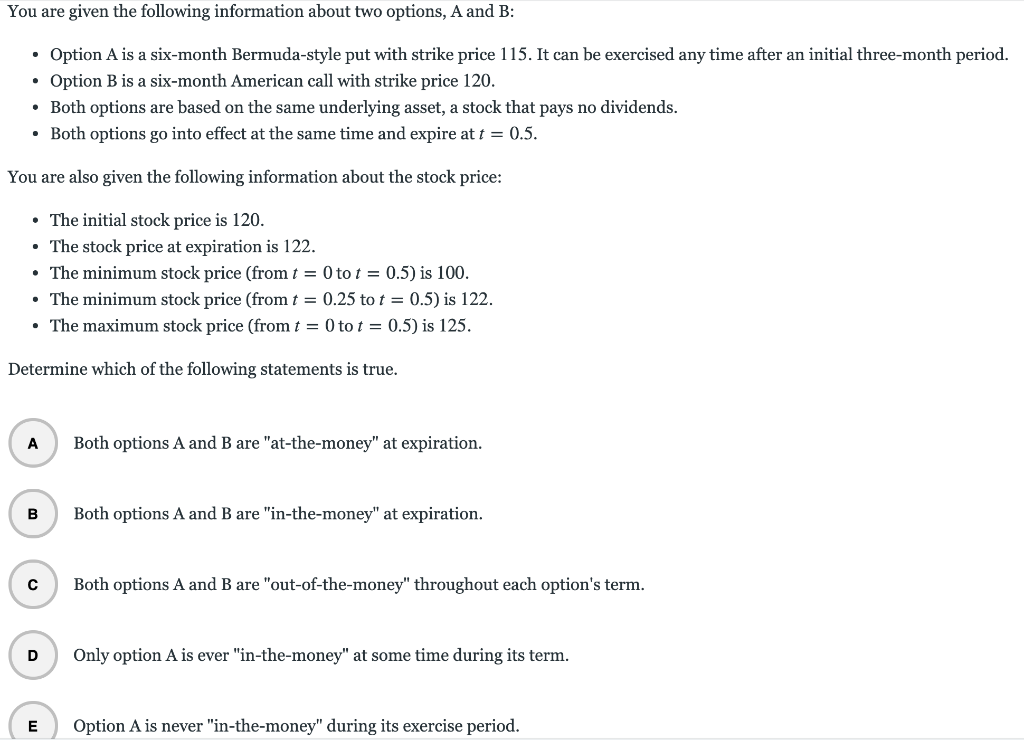

Question: You are given the following information about two options, A and B: Option A is a six-month Bermuda-style put with strike price 115115. It can

You are given the following information about two options, A and B:

- Option A is a six-month Bermuda-style put with strike price 115115. It can be exercised any time after an initial three-month period.

- Option B is a six-month American call with strike price 120120.

- Both options are based on the same underlying asset, a stock that pays no dividends.

- Both options go into effect at the same time and expire at t=0.5t=0.5.

You are also given the following information about the stock price:

- The initial stock price is 120120.

- The stock price at expiration is 122122.

- The minimum stock price (from t=0t=0 to t=0.5t=0.5) is 100100.

- The minimum stock price (from t=0.25t=0.25 to t=0.5t=0.5) is 122122.

- The maximum stock price (from t=0t=0 to t=0.5t=0.5) is 125125.

Determine which of the following statements is true.

You are given the following information about two options, A and B: Option A is a six-month Bermuda-style put with strike price 115. It can be exercised any time after an initial three- month period. Option B is a six-month American call with strike price 120. Both options are based on the same underlying asset, a stock that pays no dividends. Both options go into effect at the same time and expire at t = 0.5. You are also given the following information about the stock price: The initial stock price is 120. The stock price at expiration is 122. The minimum stock price (from t = 0 to t = 0.5) is 100. The minimum stock price (from t = 0.25 to t = 0.5) is 122. The maximum stock price (from t = 0 tot = 0.5) is 125. Determine which of the following statements is true. Both options A and B are "at-the-money" at expiration. B Both options A and B are "in-the-money" at expiration. Both options A and B are "out-of-the-money" throughout each option's term. D Only option A is ever "in-the-money" at some time during its term. E Option A is never "in-the-money" during its exercise period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts