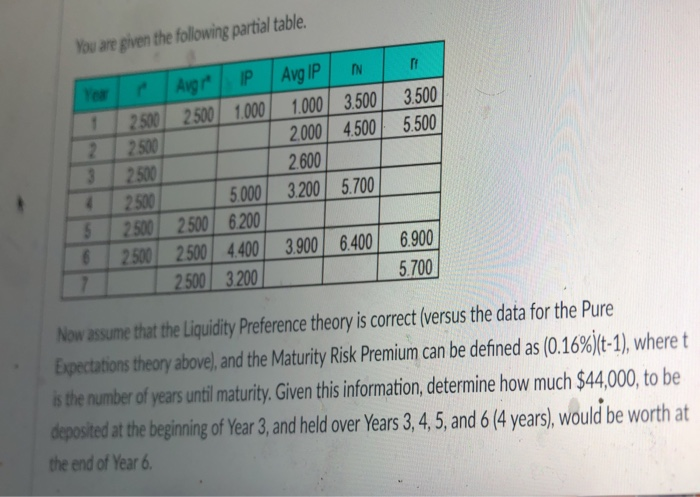

Question: You are given the following partial table 1 2500 2500 1000 1.000 3.500 3.500 000 4500 5500 2 600 2 2500 3 2500 42 500

You are given the following partial table 1 2500 2500 1000 1.000 3.500 3.500 000 4500 5500 2 600 2 2500 3 2500 42 500 5000 3.200 5.700 2500 2500 6200 2500 2500 4400 3900 6.400 6.900 5.700 Now assume that the Liquidity Preference theory is correct(versus the data for the Pure Expectations theory above, and the Maturity Risk Premium can be defined as (0.16%)(t-1), where t is the number of years until maturity. Given this information, determine how much $44,000, to be epsied at hebegpning of Year ,and held over Years 3,4,5,and 614 years), would be worthat the end of Year 6 $55,429.6 $56,781.61 $58,133.55 $59,485.50 $60,837.44 You are given the following partial table 1 2500 2500 1000 1.000 3.500 3.500 000 4500 5500 2 600 2 2500 3 2500 42 500 5000 3.200 5.700 2500 2500 6200 2500 2500 4400 3900 6.400 6.900 5.700 Now assume that the Liquidity Preference theory is correct(versus the data for the Pure Expectations theory above, and the Maturity Risk Premium can be defined as (0.16%)(t-1), where t is the number of years until maturity. Given this information, determine how much $44,000, to be epsied at hebegpning of Year ,and held over Years 3,4,5,and 614 years), would be worthat the end of Year 6 $55,429.6 $56,781.61 $58,133.55 $59,485.50 $60,837.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts