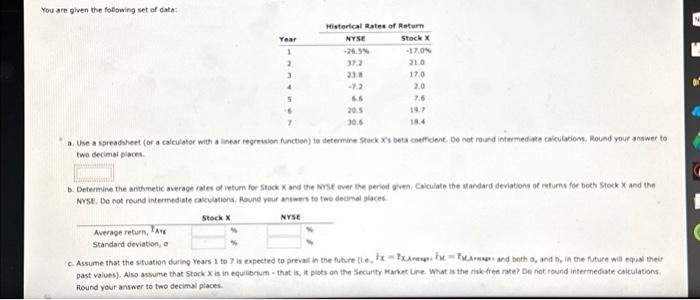

Question: You are given the following set of data: Average return, FAVS Standard deviation, a Year 1 2 3 4 Stock X 5 -6 7 %

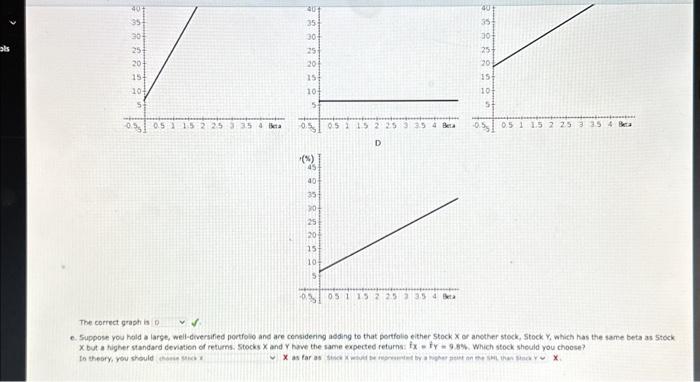

You are given the fotowing set of dath: two decimai places. Nrst. Do not reund intermediate cakclations. Round rour anewrs to tae decimat places. c. Assume that the situation during Vears 1 to 7 is expected to preval in the fuhare (2.6, ix =7x. past values). Also assume that Stock x is in equibonim - that is, it plots on the Security Marke Lre. What is the rikk-free rate? De not round interinedigte calculations. Round your answer to two decimal places. The correct graph is c. Suppose you hold a large, well-dversified portfolio and are considering adding to that pertfolo either Stock X o another stock, stock Y, which has the same beta as 5 tock to theory, vew should

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts