Question: You are looking at two options, one is a put, one is a call, each is for the same underlying stock. The put strike price

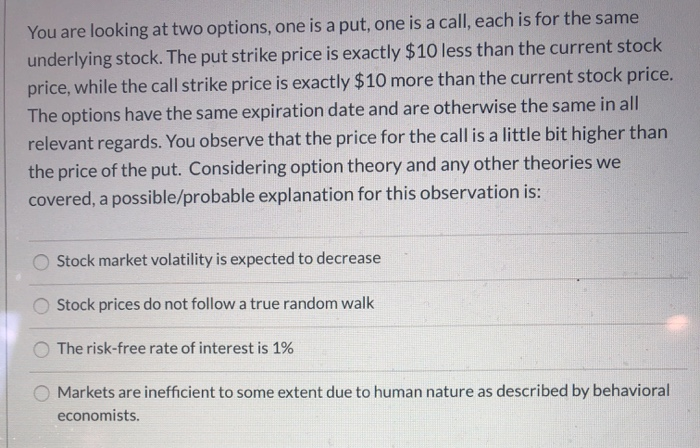

You are looking at two options, one is a put, one is a call, each is for the same underlying stock. The put strike price is exactly $10 less than the current stock price, while the call strike price is exactly $10 more than the current stock price. The options have the same expiration date and are otherwise the same in all relevant regards. You observe that the price for the call is a little bit higher than the price of the put. Considering option theory and any other theories we covered, a possible/probable explanation for this observation is: Stock market volatility is expected to decrease Stock prices do not follow a true random walk The risk-free rate of interest is 1% Markets are inefficient to some extent due to human nature as described by behavioral economists

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts