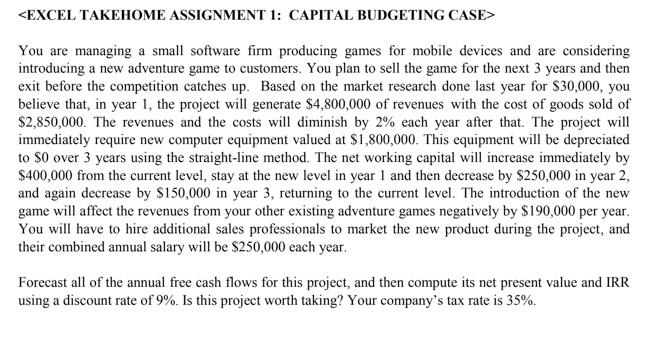

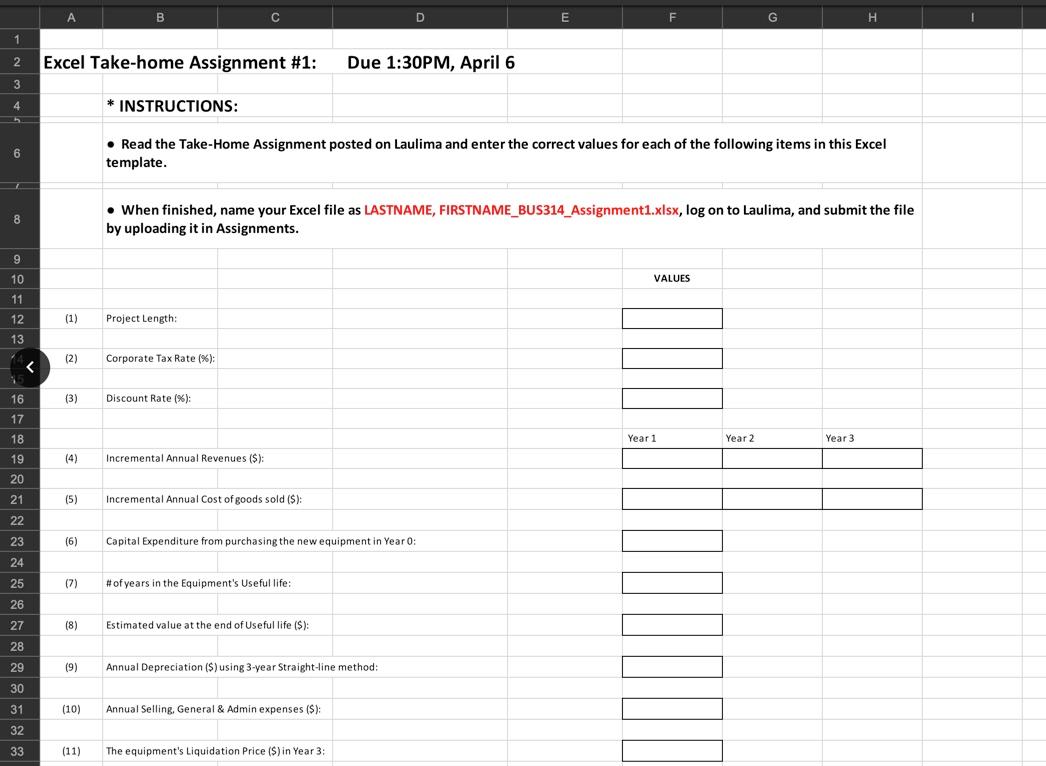

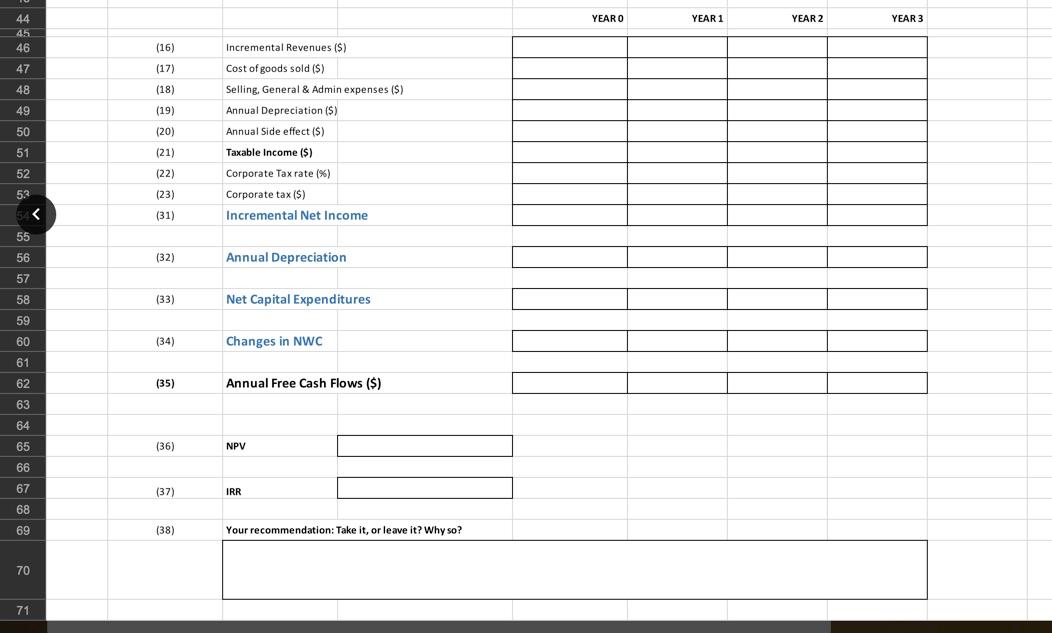

Question: You are managing a small software firm producing games for mobile devices and are considering introducing a new adventure game to customers. You plan to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock