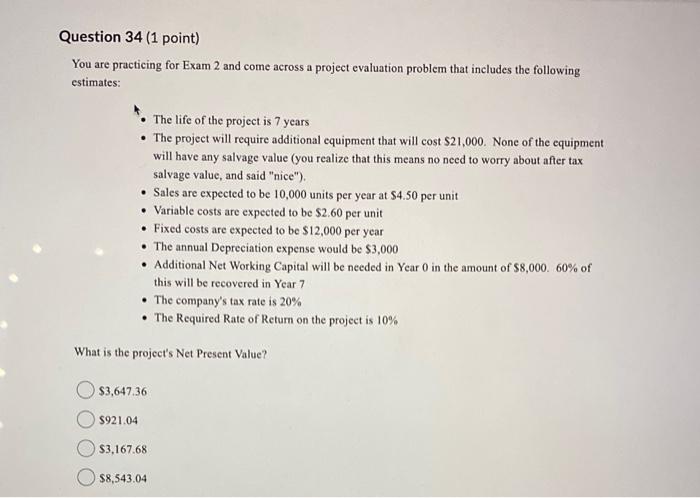

Question: You are practicing for Exam 2 and come across a project evaluation problem that includes the following estimates: - The life of the project is

You are practicing for Exam 2 and come across a project evaluation problem that includes the following estimates: - The life of the project is 7 years - The project will require additional equipment that will cost $21,000. None of the equipment will have any salvage value (you realize that this means no need to worry about after tax salvage value, and said "nice"). - Sales are expected to be 10,000 units per year at $4.50 per unit - Variable costs are expected to be $2.60 per unit - Fixed costs are expected to be $12,000 per year - The annual Depreciation expense would be $3,000 - Additional Net Working Capital will be needed in Year 0 in the amount of $8,000.60% of this will be recovered in Year 7 - The company's tax rate is 20% - The Required Rate of Retum on the project is 10% What is the project's Net Present Value? \begin{tabular}{|l} $3,647.36 \\ $921.04 \\ $3,167.68 \\ $,543.04 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts