Question: You are presented with information on expected returns and standard deviations for 2 assets and a portfolio that was formed with equal proportions of each

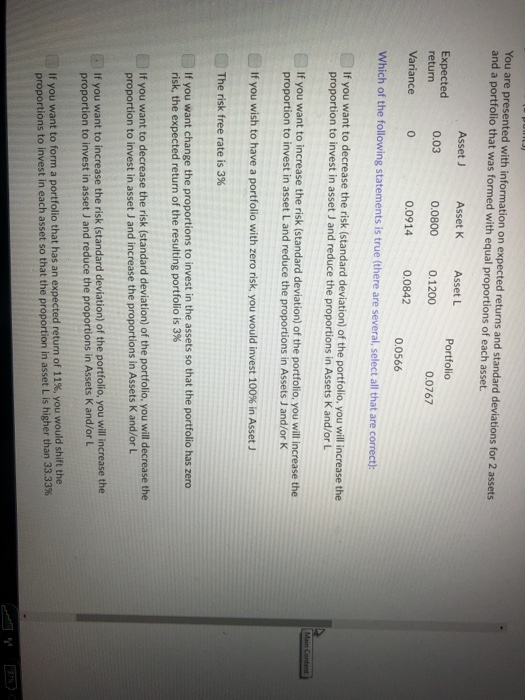

You are presented with information on expected returns and standard deviations for 2 assets and a portfolio that was formed with equal proportions of each asset. Asset J Asset K 00800 0.1200 0.0914 Asset L Portfolio Expected return 0.03 0.0767 Variance 0.0842 0.0566 Which of the following statements is true (there are several, select all that are correct): If you want to decrease the risk (standard deviation) of the portfolio, you will increase the proportion to invest in asset J and reduce the proportions in Assets K and/or L If you want to increase the risk (standard deviation) of the portfolio, you will increase the proportion to invest in asset L and reduce the proportions in Assets J and/or K if you wish to have a portfolio with zero risk, you would invest 100% in Asset The risk free rate is 3% If you want change the proportions to invest in the assets so that the portfolio has zero risk, the expected return of the resulting portfolio is 3% If you want to decrease the risk (standard deviation) of the portfolio, you will decrease the proportion to invest in asset J and increase the proportions in Assets K and/or L If you want to increase the risk (standard deviation) of the portfolio, you will increase the proportion to invest in asset J and reduce the proportions in Assets K and/or L If you want to form a portfolio that has an expected return of 11%, youwould shift the proportions to invest in each asset so that the proportion in asset L is higher than 33.33%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts