Question: IN Page 3: Page 4: Page 5: You are presented with two options to teance some receivables- Option Is a 49 day loan secured

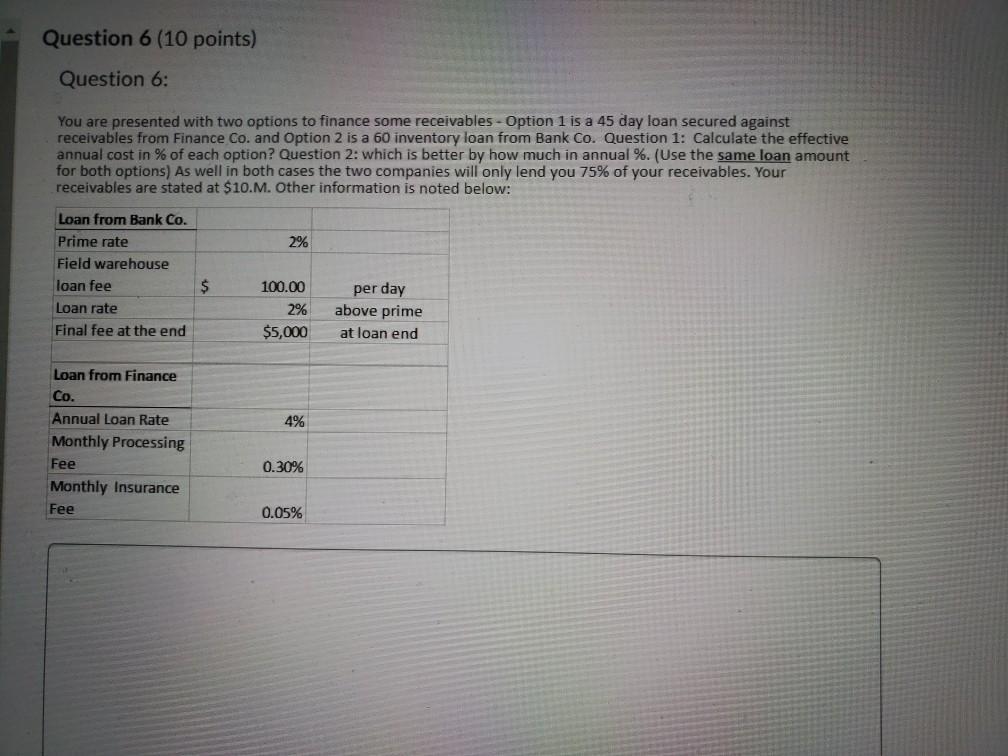

IN Page 3: Page 4: Page 5: You are presented with two options to teance some receivables- Option Is a 49 day loan secured against receivables from Finance Co. and Option 2 is a to inventory loan from Bank Co. Question 1: Calculate the effective annual cost in % of each option? Question 2: which is better by how much in annual S. (Use the same loan amount for both options) As well in both cases the two companies will only lend you 75% of your receivables. Your receivables are stated at $10M. Other information is noted teinet Loan from Bank Co. Prime rate 2% Field warehouse loan fee per day Loan rate 100.00 2% $5,000 Final fee at the end Loan from Financ Co Anmual Latar Ra 4% Monthly Processing Fee 0.30% Monthly Insurance 0.05% Fee 5 above prime at loan end Question 6 (10 points) Question 6: You are presented with two options to finance some receivables - Option 1 is a 45 day loan secured against receivables from Finance Co. and Option 2 is a 60 inventory loan from Bank Co. Question 1: Calculate the effective annual cost in % of each option? Question 2: which is better by how much in annual %. (Use the same loan amount for both options) As well in both cases the two companies will only lend you 75% of your receivables. Your receivables are stated at $10.M. Other information is noted below: Loan from Bank Co. Prime rate 2% Field warehouse loan fee 100.00 per day above prime Loan rate 2% Final fee at the end $5,000 at loan end Loan from Finance Co. Annual Loan Rate 4% Monthly Processing Fee 0.30% Monthly Insurance Fee 0.05% $

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts