Question: You are saving for a You are saving for a house that you intend to buy in exactly 5 years and need to determine whether

You are saving for a

You are saving for a

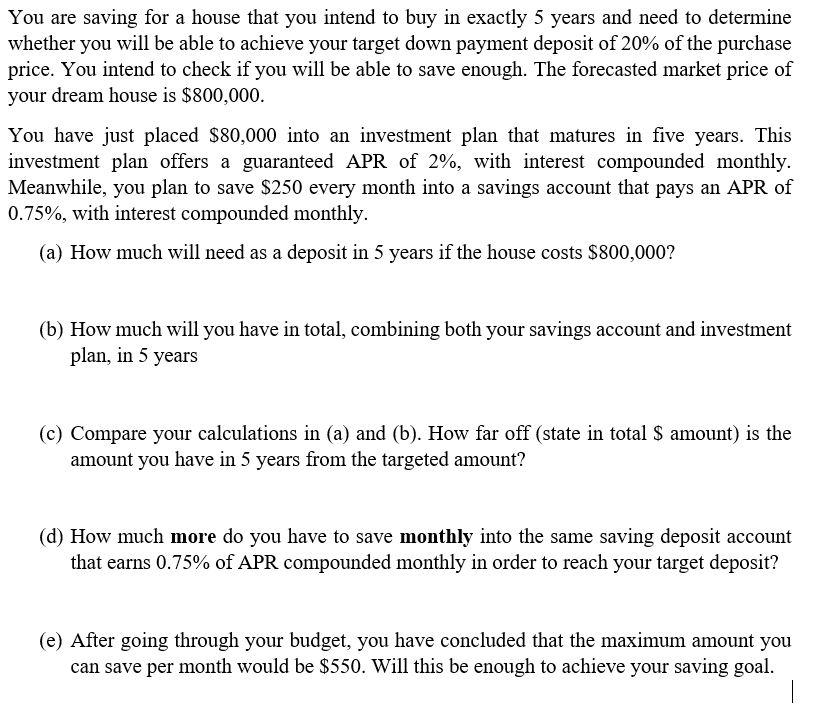

You are saving for a house that you intend to buy in exactly 5 years and need to determine whether you will be able to achieve your target down payment deposit of 20% of the purchase price. You intend to check if you will be able to save enough. The forecasted market price of your dream house is $800,000. You have just placed $80,000 into an investment plan that matures in five years. This investment plan offers a guaranteed APR of 2%, with interest compounded monthly. Meanwhile, you plan to save $250 every month into a savings account that pays an APR of 0.75%, with interest compounded monthly. (a) How much will need as a deposit in 5 years if the house costs $800,000? (b) How much will you have in total, combining both your savings account and investment plan, in 5 years (c) Compare your calculations in (a) and (b). How far off (state in total $ amount) is the amount you have in 5 years from the targeted amount? (d) How much more do you have to save monthly into the same saving deposit account that earns 0.75% of APR compounded monthly in order to reach your target deposit? (e) After going through your budget, you have concluded that the maximum amount you can save per month would be $550. Will this be enough to achieve your saving goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts