Question: You are thinking about buying a call option with a strike price of $50 which expires in 2 years (t=2). The underlying asset is currently

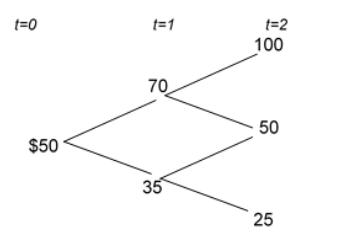

You are thinking about buying a call option with a strike price of $50 which expires in 2 years (t=2). The underlying asset is currently valued at $50 and is expected to follow a binomial process as shown in the figure below with equal probability at each branching of the tree.

The annual discount rate is 11%.

What is the payoff to the call option in t=2 if the underlying asset is $100 in year 2?

t=0 $50 t=1 70 35 t=2 100 50 25

Step by Step Solution

3.51 Rating (141 Votes )

There are 3 Steps involved in it

The payoff to the call option in t2 if the underlying asset is 100 in year 2 is 50 The option wi... View full answer

Get step-by-step solutions from verified subject matter experts