Question: You are to evaluate two mutually exclusive business projects with expected cash flows described below. Assuming a 10% weighted average cost of capital (WACC), calculate

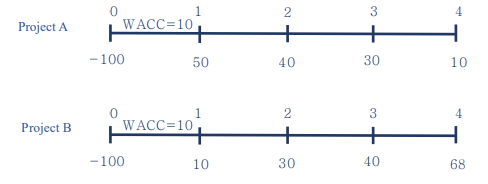

You are to evaluate two mutually exclusive business projects with expected cash flows described below. Assuming a 10% weighted average cost of capital (WACC), calculate NPV and IRR for each project and determine which project to accept.

(1) Project A's NPV (3 points):

(2) Project A's IRR (3 points):

(3) Project B's NPV (3 points):

(4) Project B's IRR (3 points):

(5) Which project should be chosen? (4 points)

2 3 4 Project A -100 WACC=10 | 50 + 40 10 30 10 Project B 1 2 WACC=10 + 3 + -100 10 30 40 68

Step by Step Solution

There are 3 Steps involved in it

Solution 1 Project As NPV The NPV of Project A can be calculated using the formula NPV C0 C1 1 r C2 ... View full answer

Get step-by-step solutions from verified subject matter experts