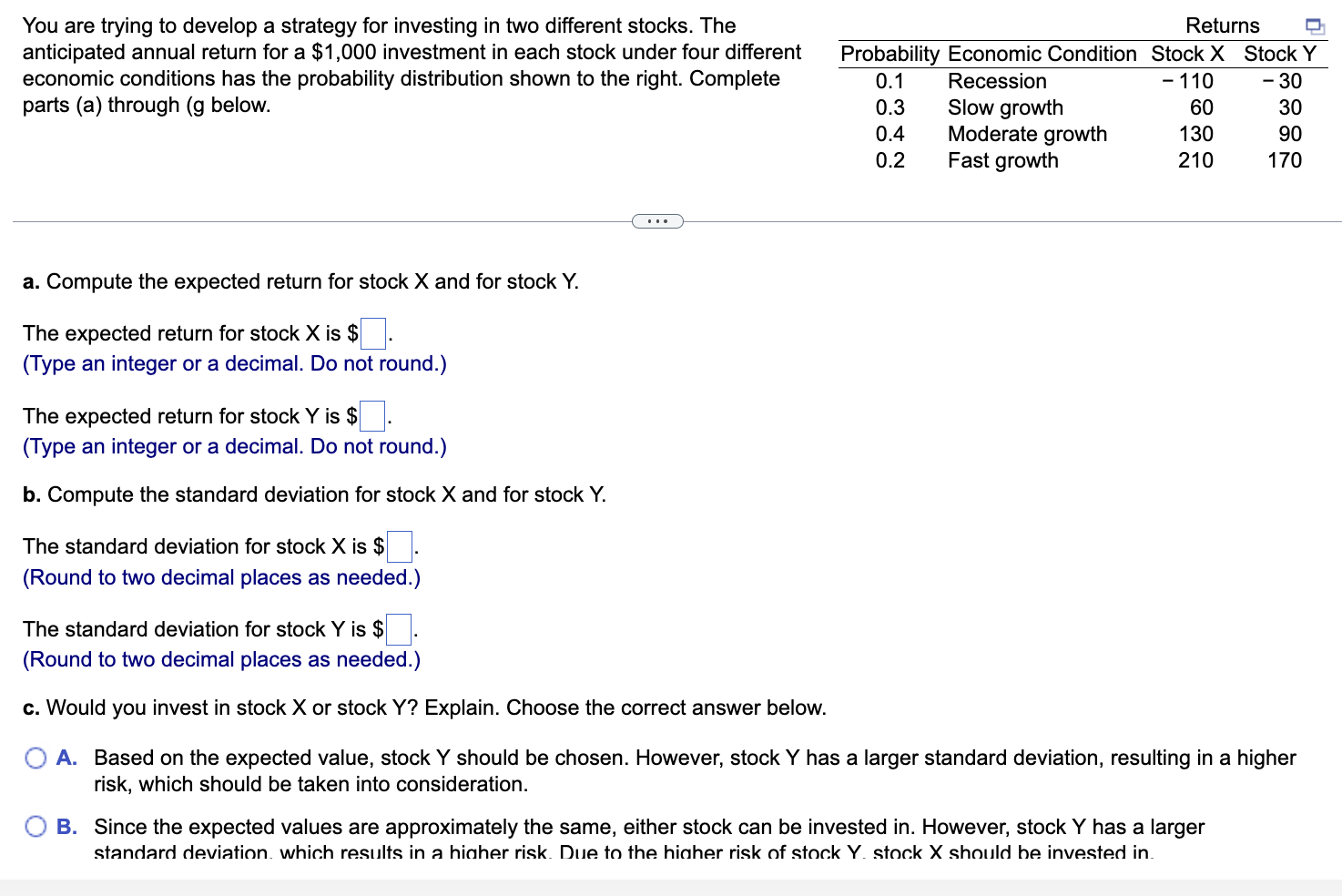

Question: You are trying to develop a strategy for investing in two different stocks. The Returns CI anticipated annual return fora $1,000 investment in each stock

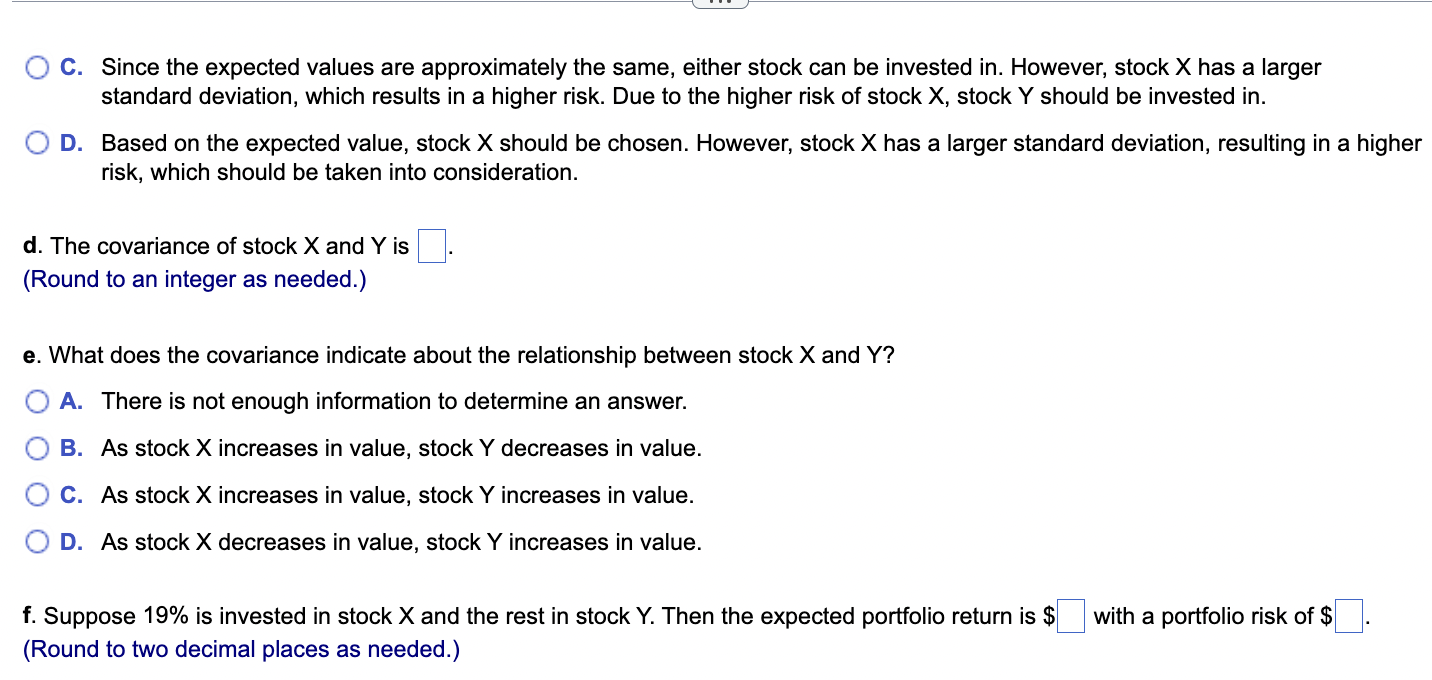

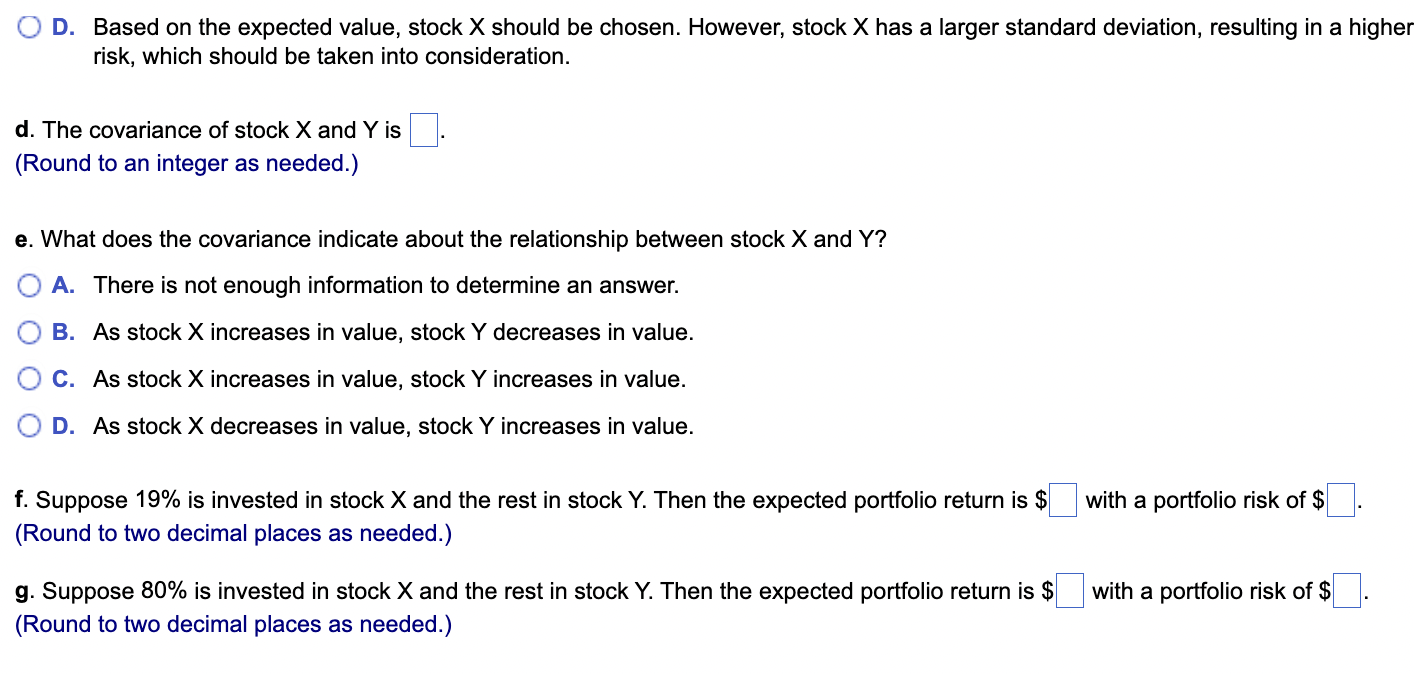

You are trying to develop a strategy for investing in two different stocks. The Returns CI anticipated annual return fora $1,000 investment in each stock under four different Probability Economic Condition StockX StockY economic conditions has the probability distribution shown to the right. Complete 01 Recession - 110 - 30 parts (a) through (g below. 0.3 Slow growth 60 30 0.4 Moderate growth 130 90 0.2 Fast growth 210 170 a. Compute the expected return for stock X and for stock Y. The expected return for stock X is $ (Type an integer or a decimal. Do not round.) The expected return for stock Y is $ . (Type an integer or a decimal. Do not round.) b. Compute the standard deviation for stock X and for stock Y. The standard deviation for stock X is $ (Round to two decimal places as needed.) The standard deviation for stock Y is $ . (Round to two decimal places as needed.) c. Would you invest in stock X or stock Y? Explain. Choose the correct answer below. ' z A. Based on the expected value, stock Y should be chosen. However, stock Y has a larger standard deviation, resulting in a higher risk, which should be taken into consideration. ' ;, B. Since the expected values are approximately the same, either stock can be invested in. However, stock Y has a larger standard deviation. which results in a hinher risk. Due to the hioher risk of stock Y. stock X should be invested in. If '2- C. Since the expected values are approximately the same, either stock can be invested in. However, stock X has a larger standard deviation, which results in a higher risk. Due to the higher risk of stock X, stock Y should be invested in. '2. I- D. Based on the expected value, stock X should be chosen. However, stock X has a larger standard deviation, resulting in a higher risk, which should be taken into consideration. d. The covariance of stock X and Y is (Round to an integer as needed.) e. What does the covariance indicate about the relationship between stock X and Y? .;;_;;. A. There is not enough information to determine an answer. {:1- B. As stock X increases in value, stock Y decreases in value. {:2- C. As stock X increases in value, stock Y increases in value. {:2- D. As stock X decreases in value, stock Y increases in value. f. Suppose 19% is invested in stock X and the rest in stock Y. Then the expected portfolio return is $ with a portfolio risk of $ (Round to two decimal places as needed.) IL} D. Based on the expected value, stockX should be chosen. However, stock X has a larger standard deviation, resulting in a higher risk, which should be taken into consideration. d. The covariance of stock X and Y is (Round to an integer as needed.) e. What does the covariance indicate about the relationship between stock X and Y? \":2- A. There is not enough information to determine an answer. {:2- B. As stock X increases in value, stock Y decreases in value. C:- C. As stock X increases in value, stock Y increases in value. {1- D. As stock X decreases in value, stock Y increases in value. f. Suppose 19% is invested in stock X and the rest in stock Y. Then the expected portfolio return is $ with a portfolio risk of $ (Round to two decimal places as needed.) 9. Suppose 80% is invested in stock X and the rest in stock Y. Then the expected portfolio return is $ with a portfolio risk of 35 (Round to two decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts