Question: You are trying to develop a strategy for investing your birthday money in two different stocks. The anticipated annual return for your investment in each

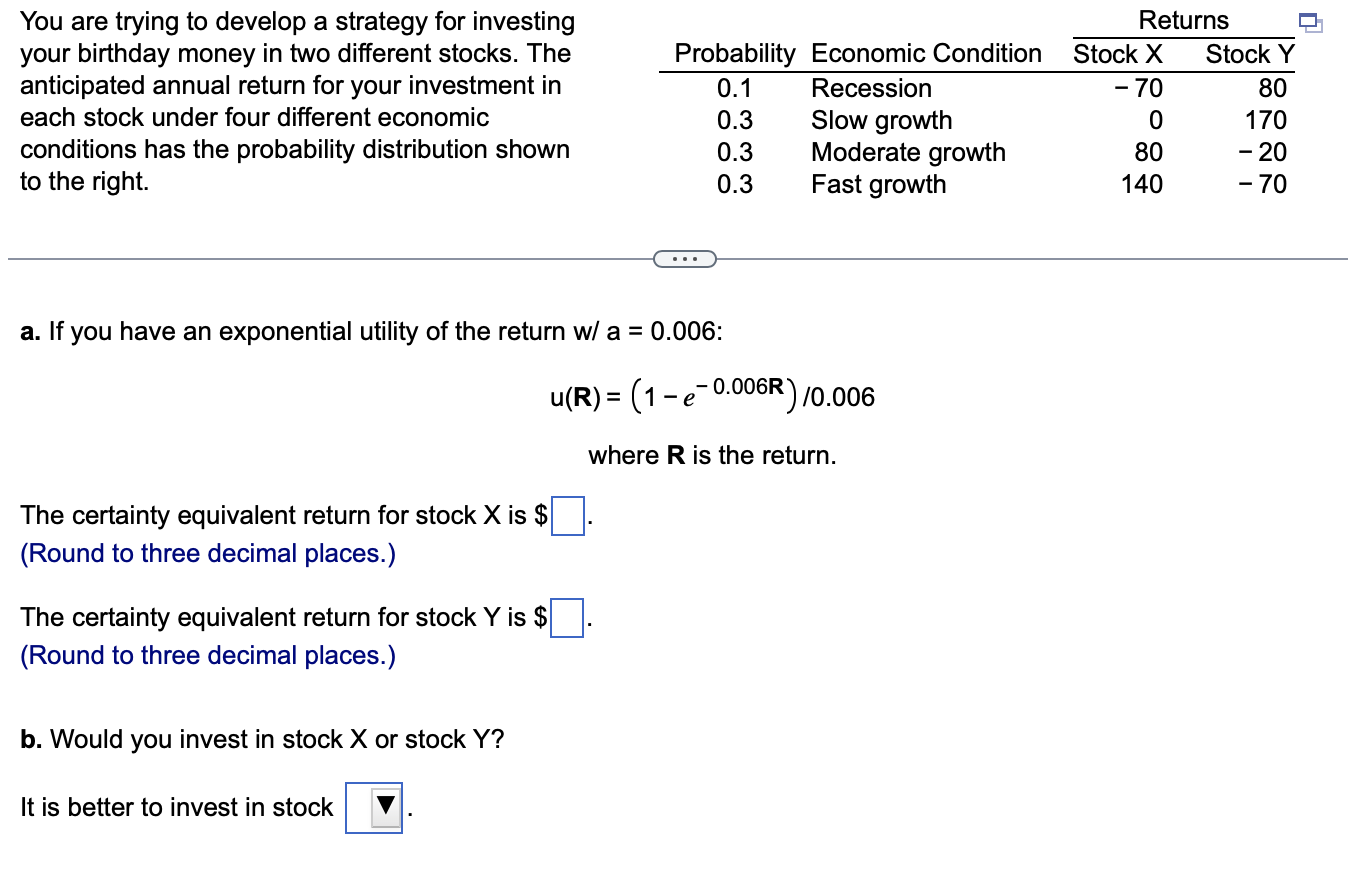

You are trying to develop a strategy for investing your birthday money in two different stocks. The anticipated annual return for your investment in each stock under four different economic conditions has the probability distribution shown to the right. a. If you have an exponential utility of the return w/a=0.006 : u(R)=(1e0.006R)/0.006 where R is the return. The certainty equivalent return for stock X is $. (Round to three decimal places.) The certainty equivalent return for stock Y is $. (Round to three decimal places.) b. Would you invest in stock X or stock Y ? It is better to invest in stock You are trying to develop a strategy for investing your birthday money in two different stocks. The anticipated annual return for your investment in each stock under four different economic conditions has the probability distribution shown to the right. a. If you have an exponential utility of the return w/a=0.006 : u(R)=(1e0.006R)/0.006 where R is the return. The certainty equivalent return for stock X is $. (Round to three decimal places.) The certainty equivalent return for stock Y is $. (Round to three decimal places.) b. Would you invest in stock X or stock Y ? It is better to invest in stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts