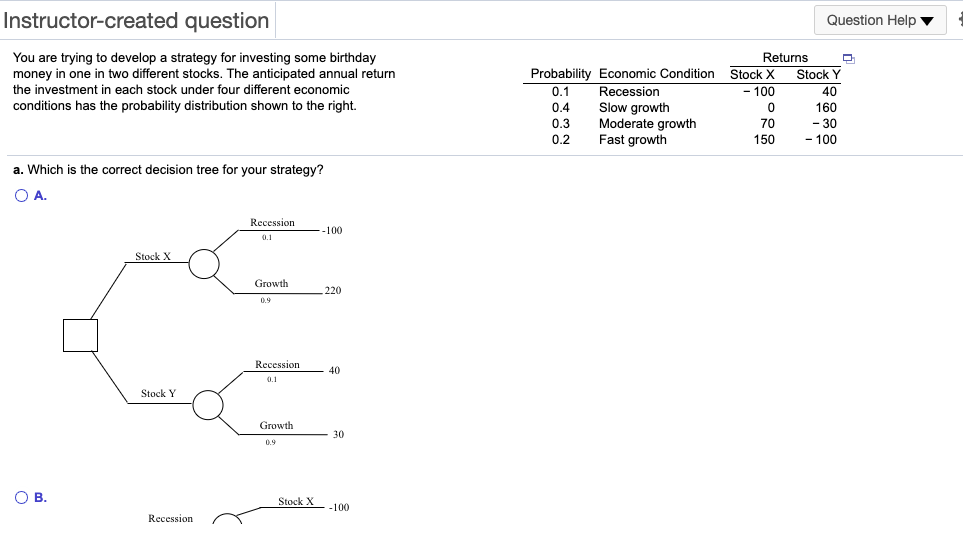

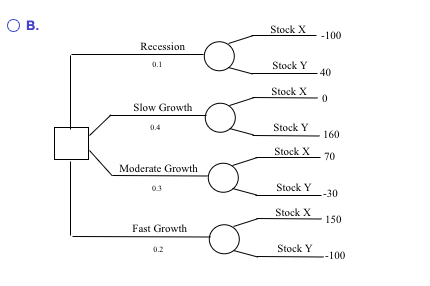

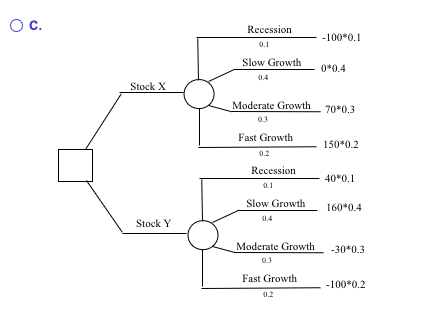

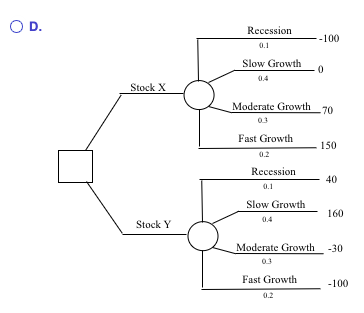

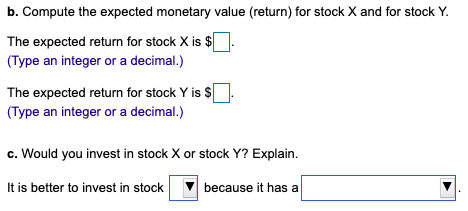

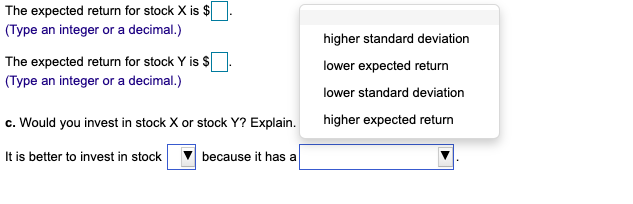

Question: Instructor-created question Question Help You are trying to develop a strategy for investing some birthday money in one in two different stocks. The anticipated annual

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock