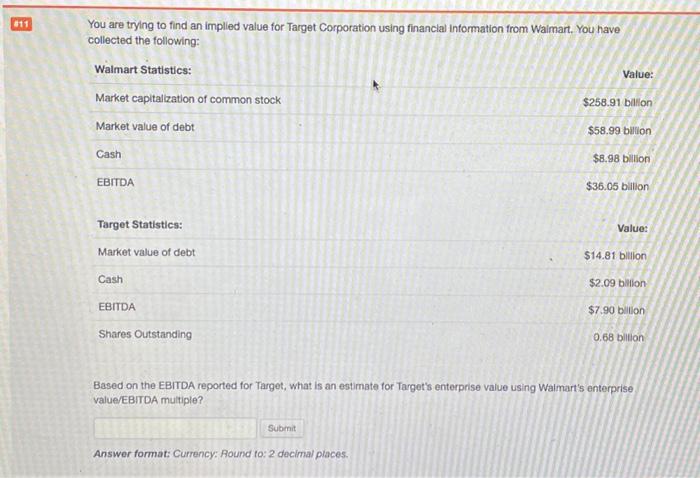

Question: You are trying to find an implied value for Target Corporation using financial information from Walmart. You have collected the following: Walmart Statistics: Value: Market

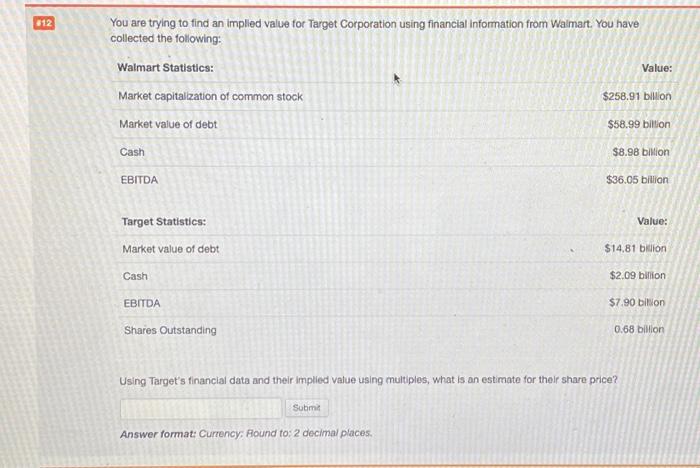

You are trying to find an implied value for Target Corporation using financial information from Walmart. You have collected the following: Walmart Statistics: Value: Market capitalization of common stock $258.91 billion Market value of debt $58.99 billion Cash $8.98 billion EBIDA $36.05 billion Target Statistics: Value: Market value of debt $14.81 billion Cash $2.09 bilion EBITDA $7.90 bilion Shares Outstanding 0.68 bilion Based on the EBITDA reported for Target, what is an estimate for Target's enterprise value using Walmart's enterprise value/EBITDA multiple? Answer format: Currency: Aound to: 2 decimal places. You are trying to find an implied value for Target Corporation using financial information from Walmart. You have collected the following: Walmart Statistics: Value: Market capitalization of common stock $258.91 billon Market value of debt $58.99 bition Cash $8.98 bilition EBITDA $36.05 billion Target Statistics: Value: Market value of debt $14.81 bilion Cash $2.09 bilition EBITDA $7.90 bilion Shares Outstanding 0.68 bition Using Target's financial data and their implied value using multiples, what is an estimate for their share price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts