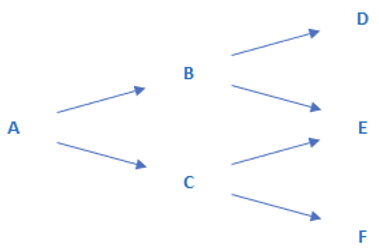

Question: You are using the binomial tree model (drawn and labelled below) to model a stocks price movements and price a 6-month European option on the

You are using the binomial tree model (drawn and labelled below) to model a stocks price movements and price a 6-month European option on the stock, which is trading at $25. The risk-free interest rate is 2% p.a.c.c. One period later, stock price in the down state will be $22. From there, when the stock price continues to go up, the option will expire worthless; when the stock price goes down instead, the option will expire with a value of $3.24.

a. Is this a call or a put?

b. Calculate the remaining stock prices and option values that correspond to every node on the tree.

c. If the option is written on a futures contract, identify the adjustment you need to make in part (b), but dont re-calculate the values.

D B A E F D B A E F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts