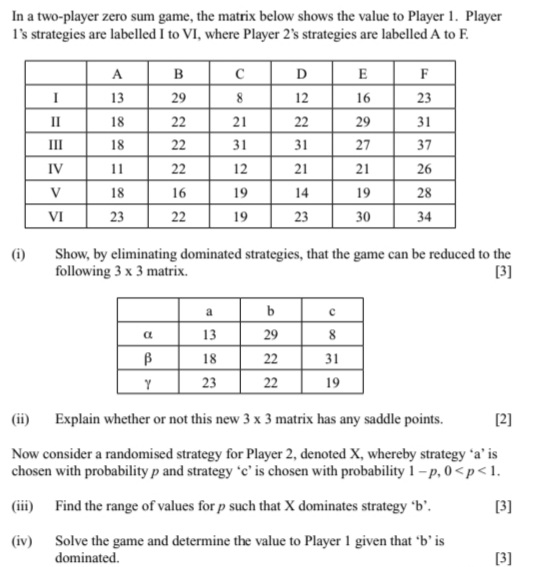

Question: Answer all! In a two-player zero sum game, the matrix below shows the value to Player 1. Player I's strategies are labelled I to VI,

Answer all!

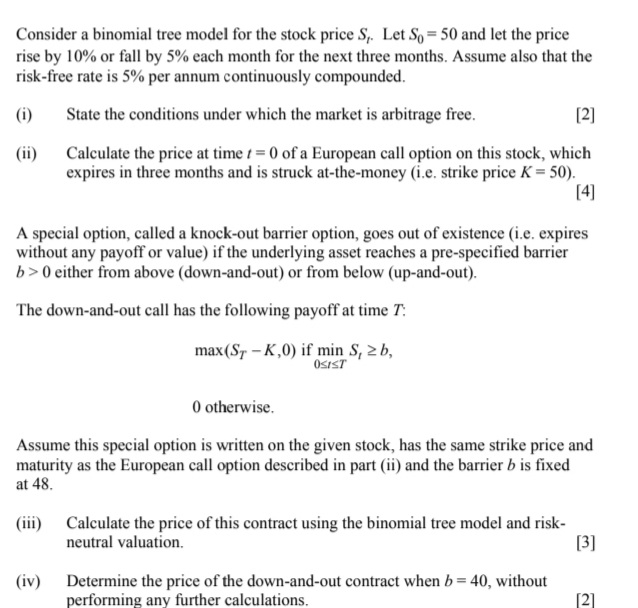

0 either from above (down-and-out) or from below (up-and-out). The down-and-out call has the following payoff at time T: max(ST - K,0) if min S, 2b, OSIST 0 otherwise. Assume this special option is written on the given stock, has the same strike price and maturity as the European call option described in part (ii) and the barrier b is fixed at 48. (iii) Calculate the price of this contract using the binomial tree model and risk- neutral valuation. [3] (iv) Determine the price of the down-and-out contract when b = 40, without performing any further calculations. [21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts