Question: Intro You are using the CAPM to find the appropriate cost of equity for a new project that pays off a little over a

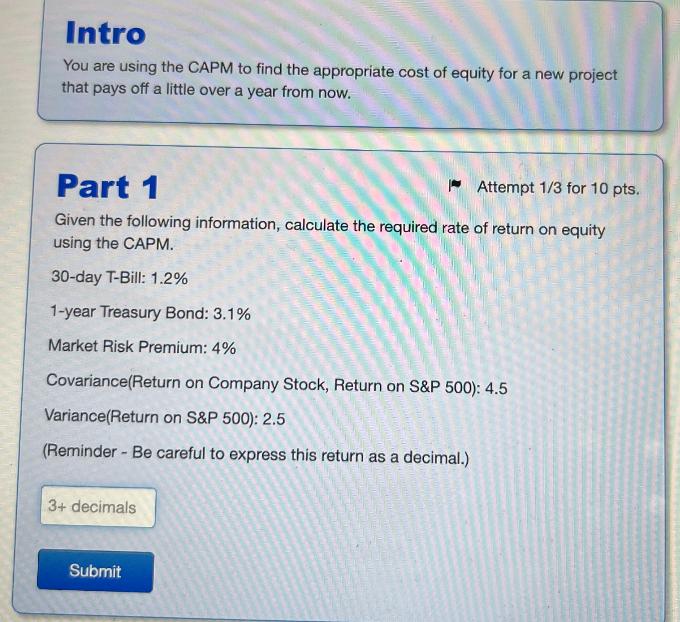

Intro You are using the CAPM to find the appropriate cost of equity for a new project that pays off a little over a year from now. Part 1 Attempt 1/3 for 10 pts. Given the following information, calculate the required rate of return on equity using the CAPM. 30-day T-Bill: 1.2% 1-year Treasury Bond: 3.1% Market Risk Premium: 4% Covariance(Return on Company Stock, Return on S&P 500): 4.5 Variance(Return on S&P 500): 2.5 (Reminder - Be careful to express this return as a decimal.) 3+ decimals Submit

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Formula The Capital Asset Pricing Model CAPM uses the following formula to determine the requ... View full answer

Get step-by-step solutions from verified subject matter experts