Question: You are working with a client who has placed a new piece of equipment in service in September, 2020. The equipment has a cost of

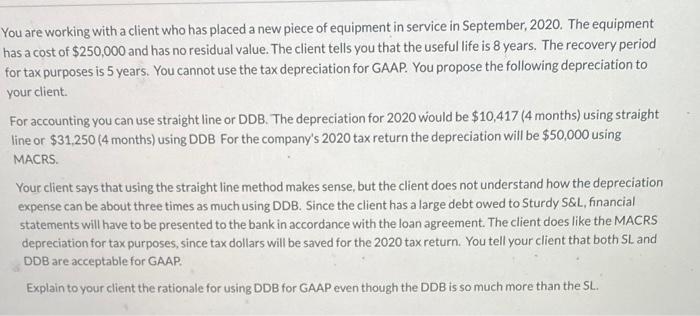

You are working with a client who has placed a new piece of equipment in service in September, 2020. The equipment has a cost of $250,000 and has no residual value. The client tells you that the useful life is 8 years. The recovery period for tax purposes is 5 years. You cannot use the tax depreciation for GAAP. You propose the following depreciation to your client For accounting you can use straight line or DDB. The depreciation for 2020 would be $10,417 (4 months) using straight line or $31.250 (4 months) using DDB For the company's 2020 tax return the depreciation will be $50,000 using MACRS. Your client says that using the straight line method makes sense, but the client does not understand how the depreciation expense can be about three times as much using DDB. Since the client has a large debt owed to Sturdy S&L, financial statements will have to be presented to the bank in accordance with the loan agreement. The client does like the MACRS depreciation for tax purposes, since tax dollars will be saved for the 2020 tax return. You tell your client that both SL and DDB are acceptable for GAAP. Explain to your client the rationale for using DDB for GAAP even though the DDB is so much more than the SL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts