Question: You can choose between making a public offering or arranging a private placement. In each case the issue involves exist30 million face value of 10-year

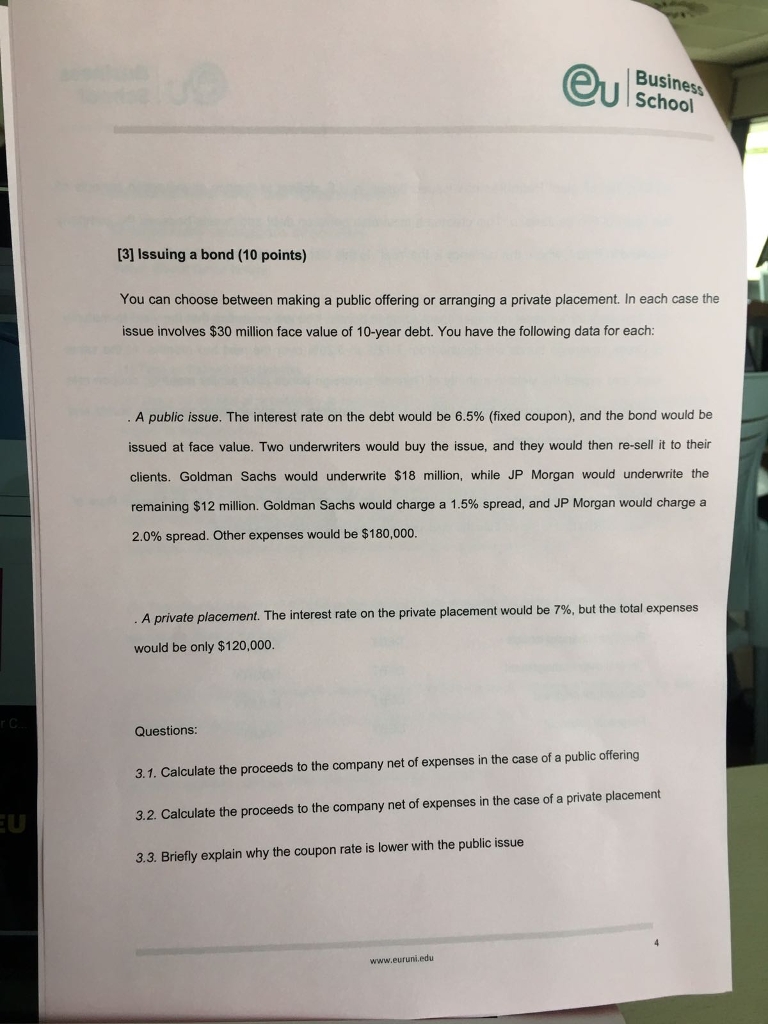

You can choose between making a public offering or arranging a private placement. In each case the issue involves exist30 million face value of 10-year debt. You have the following data for each. A public issue. The interest rate on the debt would be 6.5% (fixed coupon), and the bond would be issued at face value. Two underwriters would buy the issue, and they would then re-sell it to their clients. Goldman Sachs would underwrite exist18 million, while JP Morgan would underwrite the remaining exist12 million. Goldman Sachs would charge a 1.5% spread, and JP Morgan would charge a 2.0% spread. Other expenses would be exist180,000. A private placement. The interest rate on the private placement would be 7%, but the total expenses would be only exist120,000. Calculate the proceeds to the company net of expenses in the case of a public offering Calculate the proceeds to the company net of expenses in the case of a private placement Briefly explain why the coupon rate is lower with the public issue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts