Question: You can write whatever you have. You do not have to answer all of the problems. Thanks a lot. 3. Suppose everyone in the U.S.

You can write whatever you have. You do not have to answer all of the problems. Thanks a lot.

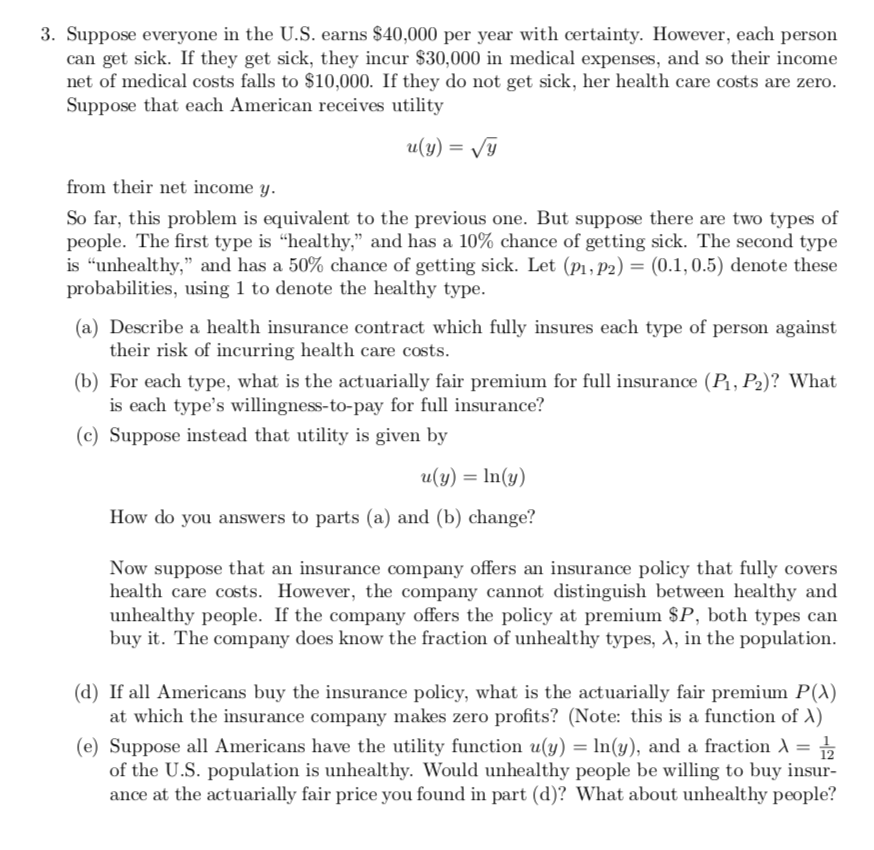

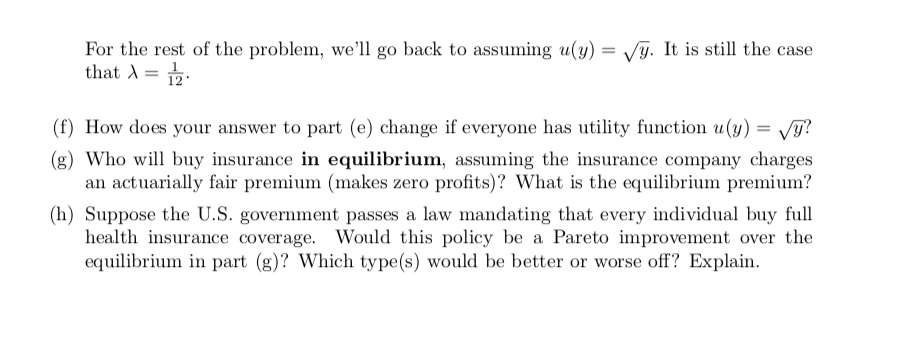

3. Suppose everyone in the U.S. earns $40,000 per year with certainty. However, each person can get sick. If they get sick, they incur $30,000 in medical expenses, and so their income net of medical costs falls to $10,000. If they do not get sick, her health care costs are zero. Suppose that each American receives utility u(y) = Vy from their net income y. So far, this problem is equivalent to the previous one. But suppose there are two types of people. The first type is healthy," and has a 10% chance of getting sick. The second type is unhealthy," and has a 50% chance of getting sick. Let (P1, P2) = (0.1, 0.5) denote these probabilities, using 1 to denote the healthy type. (a) Describe a health insurance contract which fully insures each type of person against their risk of incurring health care costs. (b) For each type, what is the actuarially fair premium for full insurance (P1, P2)? What is each type's willingness-to-pay for full insurance? (C) Suppose instead that utility is given by u(y) = ln(y) How do you answers to parts (a) and (b) change? Now suppose that an insurance company offers an insurance policy that fully covers health care costs. However, the company cannot distinguish between healthy and unhealthy people. If the company offers the policy at premium $P, both types can buy it. The company does know the fraction of unhealthy types, 1, in the population. (d) If all Americans buy the insurance policy, what is the actuarially fair premium P(a) at which the insurance company makes zero profits? (Note: this is a function of 1) (e) Suppose all Americans have the utility function u(y) = ln(y), and a fraction 1 = 2 of the U.S. population is unhealthy. Would unhealthy people be willing to buy insur- ance at the actuarially fair price you found in part (d)? What about unhealthy people? For the rest of the problem, we'll go back to assuming u(y) = y. It is still the case that 1 = 12 (f) How does your answer to part (e) change if everyone has utility function u(y) = vy? (g) Who will buy insurance in equilibrium, assuming the insurance company charges an actuarially fair premium (makes zero profits)? What is the equilibrium premium? (h) Suppose the U.S. government passes a law mandating that every individual buy full health insurance coverage. Would this policy be a Pareto improvement over the equilibrium in part (g)? Which type(s) would be better or worse off? Explain. 3. Suppose everyone in the U.S. earns $40,000 per year with certainty. However, each person can get sick. If they get sick, they incur $30,000 in medical expenses, and so their income net of medical costs falls to $10,000. If they do not get sick, her health care costs are zero. Suppose that each American receives utility u(y) = Vy from their net income y. So far, this problem is equivalent to the previous one. But suppose there are two types of people. The first type is healthy," and has a 10% chance of getting sick. The second type is unhealthy," and has a 50% chance of getting sick. Let (P1, P2) = (0.1, 0.5) denote these probabilities, using 1 to denote the healthy type. (a) Describe a health insurance contract which fully insures each type of person against their risk of incurring health care costs. (b) For each type, what is the actuarially fair premium for full insurance (P1, P2)? What is each type's willingness-to-pay for full insurance? (C) Suppose instead that utility is given by u(y) = ln(y) How do you answers to parts (a) and (b) change? Now suppose that an insurance company offers an insurance policy that fully covers health care costs. However, the company cannot distinguish between healthy and unhealthy people. If the company offers the policy at premium $P, both types can buy it. The company does know the fraction of unhealthy types, 1, in the population. (d) If all Americans buy the insurance policy, what is the actuarially fair premium P(a) at which the insurance company makes zero profits? (Note: this is a function of 1) (e) Suppose all Americans have the utility function u(y) = ln(y), and a fraction 1 = 2 of the U.S. population is unhealthy. Would unhealthy people be willing to buy insur- ance at the actuarially fair price you found in part (d)? What about unhealthy people? For the rest of the problem, we'll go back to assuming u(y) = y. It is still the case that 1 = 12 (f) How does your answer to part (e) change if everyone has utility function u(y) = vy? (g) Who will buy insurance in equilibrium, assuming the insurance company charges an actuarially fair premium (makes zero profits)? What is the equilibrium premium? (h) Suppose the U.S. government passes a law mandating that every individual buy full health insurance coverage. Would this policy be a Pareto improvement over the equilibrium in part (g)? Which type(s) would be better or worse off? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts