Question: solve please Recording Entries for Equity Investment: Equity Method, Partial Year On July 1, Allen Corporation purchased 304 of the 72,000 outstanding common shares of

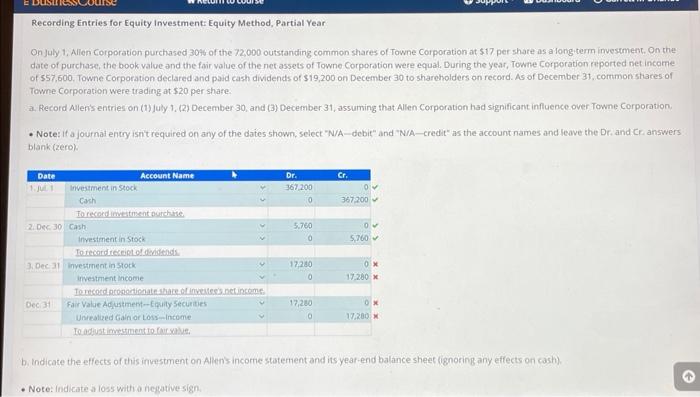

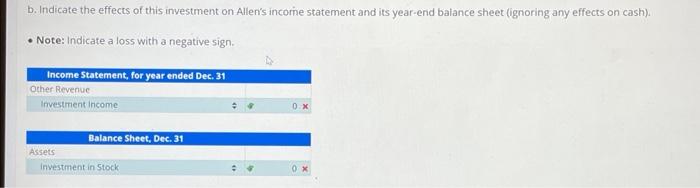

Recording Entries for Equity Investment: Equity Method, Partial Year On July 1, Allen Corporation purchased 304 of the 72,000 outstanding common shares of Towne Corporation at $17 per share as a longiterm imvesiment, On the date of purchase, the book value and the fair value of the net assets of Towne Corporation were equal, Daring the year, Towne Corporation raported net income of 557,600 , Towne Corporation declared and paid cash dividends of $19,200 on December 30 to shareholders on record. As of December 31 , commonstiaces of Towne Corporation were trading at $20 per shafe. 3a. Record Allen's entries on (1) juby 1. (2) December 30, and (3) December 31, assuming that Allen Corporation had significant influence over Towne Corporation. - Note: if a journat entry isn't required on any of the dates shown, select "N/A-debit" and "N/A-credit" as the account names and leave the Dr. and Cr. answers blank (2+e2) b. indicate the effects of this irivestment on Algens incorne staternent and its yeaf-end balance sheec (ignoring any effects on cash). - Note: Indicate a loss with o hegativesign. b. Indicate the effects of this investment on Allen's incorne statement and its year-end baiance sheet (ignoring any effects on cash). - Note: Indicate a loss with a negative sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts