Question: You cannot use financial calculators to solve the HW . You need to use the formulas provided in class and in the textbook ( if

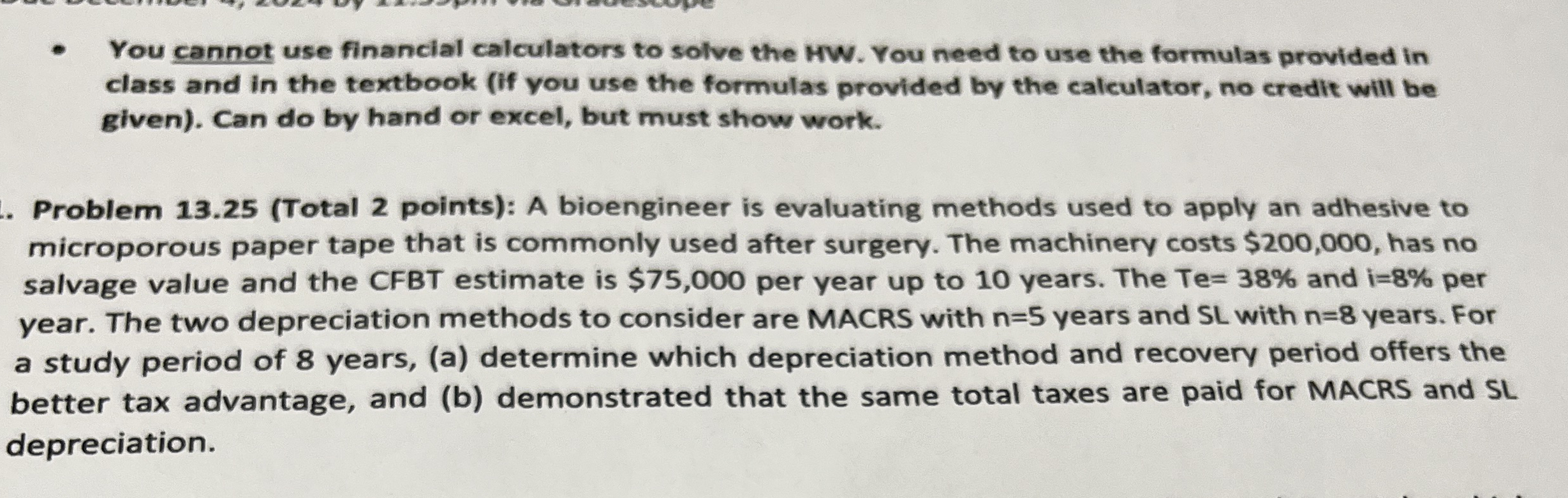

You cannot use financial calculators to solve the HW You need to use the formulas provided in class and in the textbook if you use the formulas provided by the calculator, no credit will be given Can do by hand or excel, but must show work.

Problem Total points: A bioengineer is evaluating methods used to apply an adhesive to microporous paper tape that is commonly used after surgery. The machinery costs $ has no salvage value and the CFBT estimate is $ per year up to years. The and per year. The two depreciation methods to consider are MACRS with years and SL with years. For a study period of years, a determine which depreciation method and recovery period offers the better tax advantage, and b demonstrated that the same total taxes are paid for MACRS and SL depreciation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock