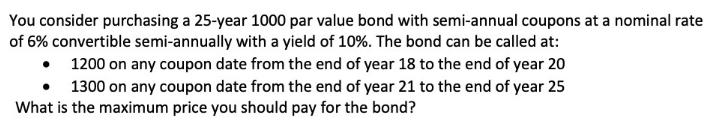

Question: You consider purchasing a 25-year 1000 par value bond with semi-annual coupons at a nominal rate of 6% convertible semi-annually with a yield of

You consider purchasing a 25-year 1000 par value bond with semi-annual coupons at a nominal rate of 6% convertible semi-annually with a yield of 10%. The bond can be called at: 1200 on any coupon date from the end of year 18 to the end of year 20 1300 on any coupon date from the end of year 21 to the end of year 25 What is the maximum price you should pay for the bond?

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

To calculate the maximum price you should pay for the bond we need to find the present value of all ... View full answer

Get step-by-step solutions from verified subject matter experts