Question: You decide to split your money between two mutual funds. Your main goal is, of course, to earn as much money on your investments as

You decide to split your money between two mutual funds. Your main goal is, of course, to earn as much money on your investments as possible, but you also know that there is risk involved in trading on the stock market. How do you balance your investments in order to maximize return and minimize risk?

1. Define the variables and as the amounts to be invested in each mutual fund.

2. Use the information you gathered on the funds performance to construct an objective function for the total expected return on your investment.

3. Use the information you gathered on the funds risk to construct an objective function for the total risk involved in purchasing both funds. We will use a calculation of Std. Dev. Amount to measure the risk of purchasing shares of a fund.

4. Identify your constraint inequalities

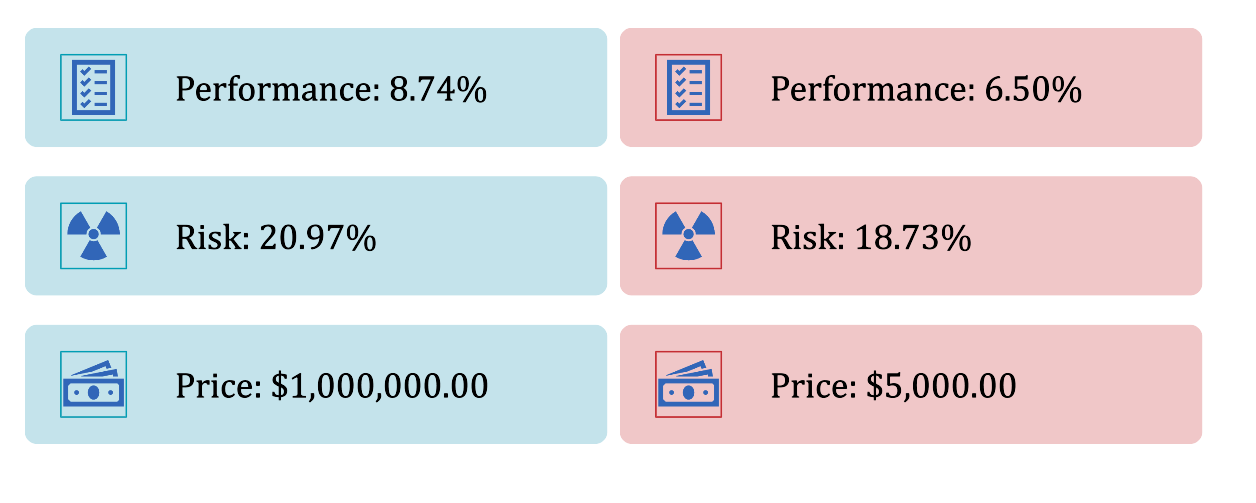

Performance: 8.74\% Performance: 6.50% Risk: 20.97% Risk: 18.73% Price: $1,000,000.00 Price: $5,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts