Question: You decide to split your money between two mutual funds. Your main goal is, of course, to earn as much money on your investments as

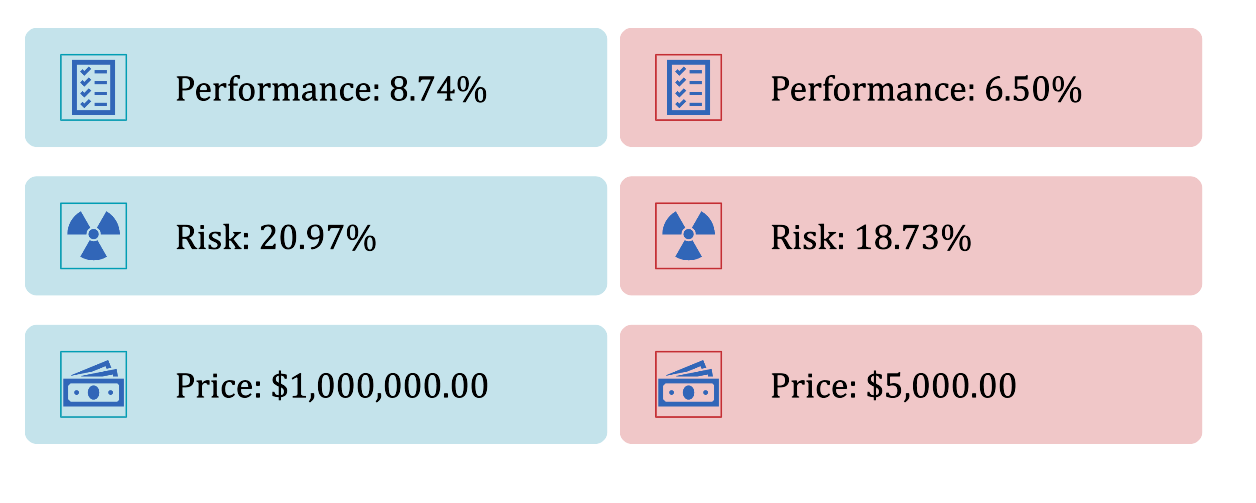

You decide to split your money between two mutual funds. Your main goal is, of course, to earn as much money on your investments as possible, but you also know that there is risk involved in trading on the stock market. How do you balance your investments in order to maximize return and minimize risk? The image below shows bond 1 and bond 2.

1. Define the variables and as the amounts to be invested in each mutual fund.

(,)= 0.0874 + 0.0650 (maximize return)

(,) = 0.2097() + 0.1873() (minimize risk)

2. Identify your constraint inequalities by considering these limitations

The minimum amount needed to start investing in each fund.

The maximum total amount that you have available to invest. To ensure a good range for your results, choose a reasonable number that is at least twice as much as the total minimum amount to purchase the two funds.

suppose you intend that the difference between the amounts invested in each fund be no more than 25% of the maximum total amount.

3. Graph the feasible region

4. Solve algebraically for corner points

5. Optimize the objective functions

**Please show all work so I can understand this concept**

Performance: 8.74\% Performance: 6.50% Risk: 20.97% Risk: 18.73% Price: $1,000,000.00 Price: $5,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts