Question: Adjusting Entry Information 1. Depreciation has not been booked for the year. Depreciation is $10,000. 2. Unearned revenue earned as of yearend is $1,000

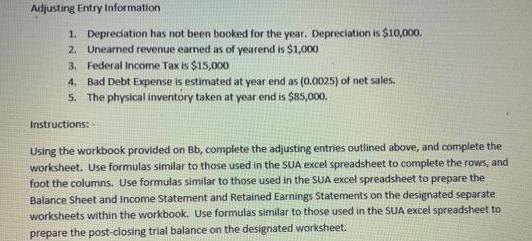

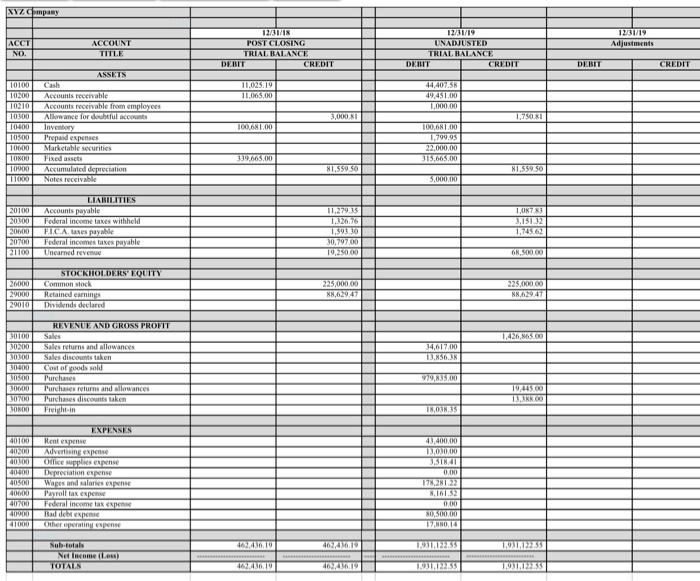

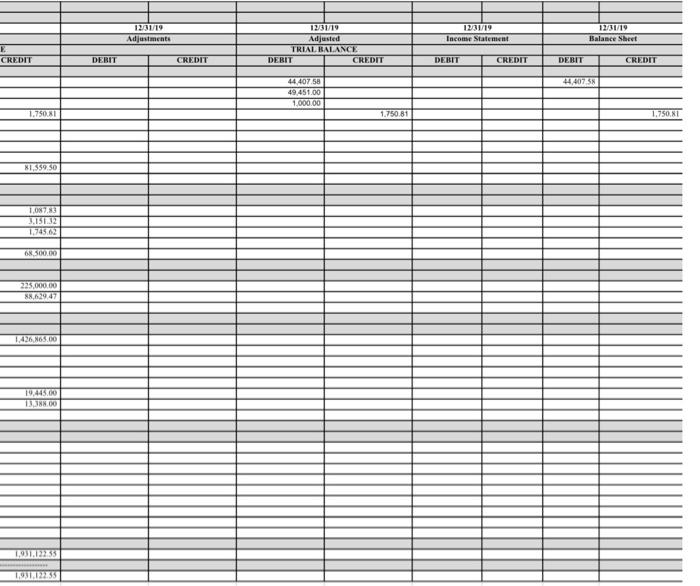

Adjusting Entry Information 1. Depreciation has not been booked for the year. Depreciation is $10,000. 2. Unearned revenue earned as of yearend is $1,000 3. Federal Income Tax is $15,000 4. Bad Debt Expense is estimated at year end as (0.0025) of net sales. 5. The physical inventory taken at year end is $85,000. Instructions: Using the workbook provided on Bb, complete the adjusting entries outlined above, and complete the worksheet. Use formulas similar to those used in the SUA excel spreadsheet to complete the rows, and foot the columns. Use formulas similar to those used in the SUA excel spreadsheet to prepare the Balance Sheet and Income Statement and Retained Earnings Statements on the designated separate worksheets within the workbook. Use formulas similar to those used in the SUA excel spreadsheet to prepare the post-closing trial balance on the designated worksheet. XYZ Company ACCT NO. 10100 Cash 10200 Accounts receivable 10210 Accounts receivable from employees 10300 Allowance for doubtful accounts 10400 Inventory 20100 20300 20600 20700 21100 10500 Prepaid expenses 10600 Marketable securities 10800 10900 11000 Notes receivable 26000 29000 20010 30200 30300 30400 30500 30000 30700 30800 ACCOUNT TITLE 40100 40200 40300 40400 40500 40000 40700 40900 ASSETS Fixed assets Accumulated depreciation 30100 Sales Accounts payable Federal income taxes withheld FLC.A. taxes payable Federal incomes taxes payable Unearned revenue LIABILITIES STOCKHOLDERS' EQUITY Common stock Retained earnings Dividends declared REVENUE AND GROSS PROFIT Sales returns and allowances Sales discounts taken Cost of goods sold Purchases Purchases returns and allowances Purchases discounts taken Freight-in Sub-totals Rent expense Advertising expense Office supplies expense Depreciation expense Wages and salaries expense Payroll tax expense Federal income tax expense Bad debt expense 41000 Other operating expense TOTALS EXPENSES Net Income (Loss) 12/31/18 POST CLOSING TRIAL BALANCE DEBIT 11.025.19 11,065,00 100,681.00 339.665.00 462,436.19 462.436.19 CREDIT 3,000.81 81,559.50 11,279.35 1,326.76 1.593.30 30,797.00 19,250.00 225,000.00 88,629.47 462,436.19 462,436.19 12/31/19 UNADJUSTED TRIAL BALANCE DEBIT 44,407.58 49,451.00 1,000.00 100,681.00 1,799,95 22,000.00 315,665.00 5.000.00 34,617.00 13,856.38 979,835.00 18,038.35 43,400.00 13,030,00 3,518.41 0.00 178,281.22 8.161.52 0,00 80,500.00 17,880,14 1,931-12235 1.931.122.55 CREDIT 1,750.81 81,559.50 1,08783 3,151.32 1,745.62 68,500.00 225,000.00 88,629.47 1,426,865.00 19,445.00 13,3KK.00 1,931-122.35 **************** 1,931.122.55 DEBIT 12/31/19 Adjustments CREDIT E CREDIT 1,750.81 81,559.50 1.087.83 3,151.32 1,745.62 68,500.00 225,000.00 88,629.47 1,426,865.00 19,445.00 13,388.00 1.931.122.55 1,931.122.55 DEBIT 12/31/19 Adjustments CREDIT 12/31/19 Adjusted TRIAL BALANCE DEBIT 44,407.58 49,451.00 1,000.00 CREDIT 1.750.81 12/31/19 Income Statement DEBIT CREDIT DEBIT 12/31/19 Balance Sheet 44,407.58 CREDIT 1,750.81

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Question Stepbystep explanation Answer... View full answer

Get step-by-step solutions from verified subject matter experts