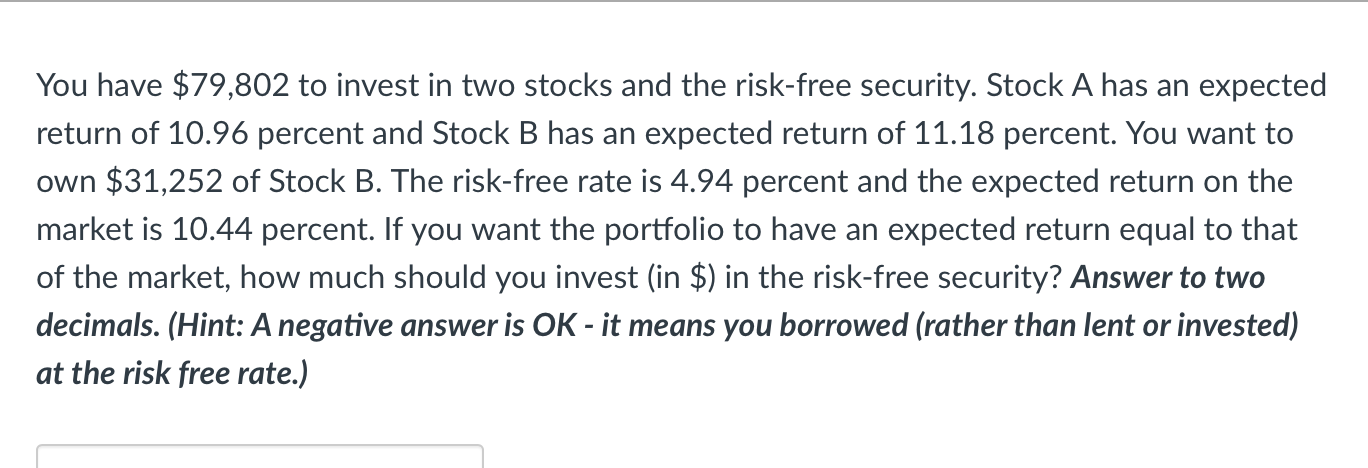

Question: You have ( $ 7 9 , 8 0 2 ) to invest in two stocks and the risk - free security.

You have $ to invest in two stocks and the riskfree security. Stock A has an expected return of percent and Stock B has an expected return of percent. You want to own $ of Stock B The riskfree rate is percent and the expected return on the market is percent. If you want the portfolio to have an expected return equal to that of the market, how much should you invest in $ in the riskfree security? Answer to two decimals. Hint: A negative answer is OK it means you borrowed rather than lent or invested at the risk free rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock