Question: You have a 10 yr bond which has a face value of $1000 and a coupon rate of 6% that is paid semi annually.

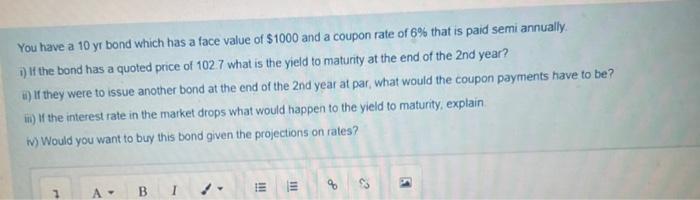

You have a 10 yr bond which has a face value of $1000 and a coupon rate of 6% that is paid semi annually. i) If the bond has a quoted price of 102.7 what is the yield to maturity at the end of the 2nd year? i) If they were to issue another bond at the end of the 2nd year at par, what would the coupon payments have to be? ii) If the interest rate in the market drops what would happen to the yield to maturity, explain iv) Would you want to buy this bond given the projections on rates? 1 A- B I 00 23 3

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

i YTM 600 ii Coupon payments would have to be 6 of the face value of the bond 1000 or 60 per year ii... View full answer

Get step-by-step solutions from verified subject matter experts