Question: You have a client who is preparing for their child's college. If tuition will be $15,000 a year and is needed for 4 years,

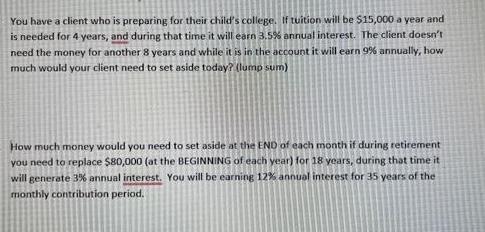

You have a client who is preparing for their child's college. If tuition will be $15,000 a year and is needed for 4 years, and during that time it will earn 3.5% annual interest. The client doesn't need the money for another 8 years and while it is in the account it will earn 9% annually, how much would your client need to set aside today? (lump sum) How much money would you need to set aside at the END of each month if during retirement you need to replace $80,000 (at the BEGINNING of each year) for 18 years, during that time it will generate 3% annual interest. You will be earning 12% annual interest for 35 years of the monthly contribution period.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

For the first question The tuition will be 15000 a year for 4 years so the total cost of tuition will be 15000 4 60000 The money is not needed for ano... View full answer

Get step-by-step solutions from verified subject matter experts