Question: You have also been asked for your views on three unrelated sets of projects. Each set of projects involves two mutually exclusive projects. These projects

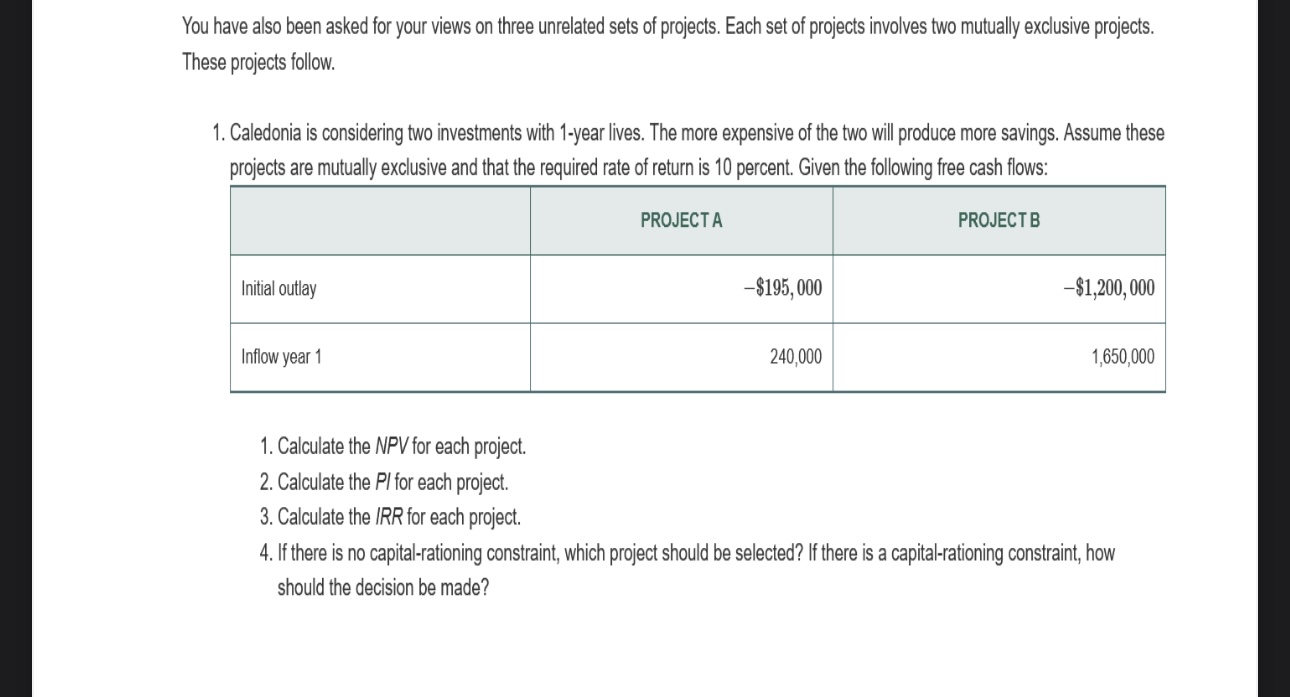

You have also been asked for your views on three unrelated sets of projects. Each set of projects involves two mutually exclusive projects.

These projects follow.

Caledonia is considering two investments with year lives. The more expensive of the two will produce more savings. Assume these

projects are mutually exclusive and that the required rate of return is percent. Given the following free cash flows:

Calculate the NPV for each project.

Calculate the PI for each project.

Calculate the IRR for each project.

If there is no capitalrationing constraint, which project should be selected? If there is a capitalrationing constraint, how

should the decision be made?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock