Question: You have been approached by a developer with South Carolina solar project. Your manager wants to understand how attractive S.C. market could be or

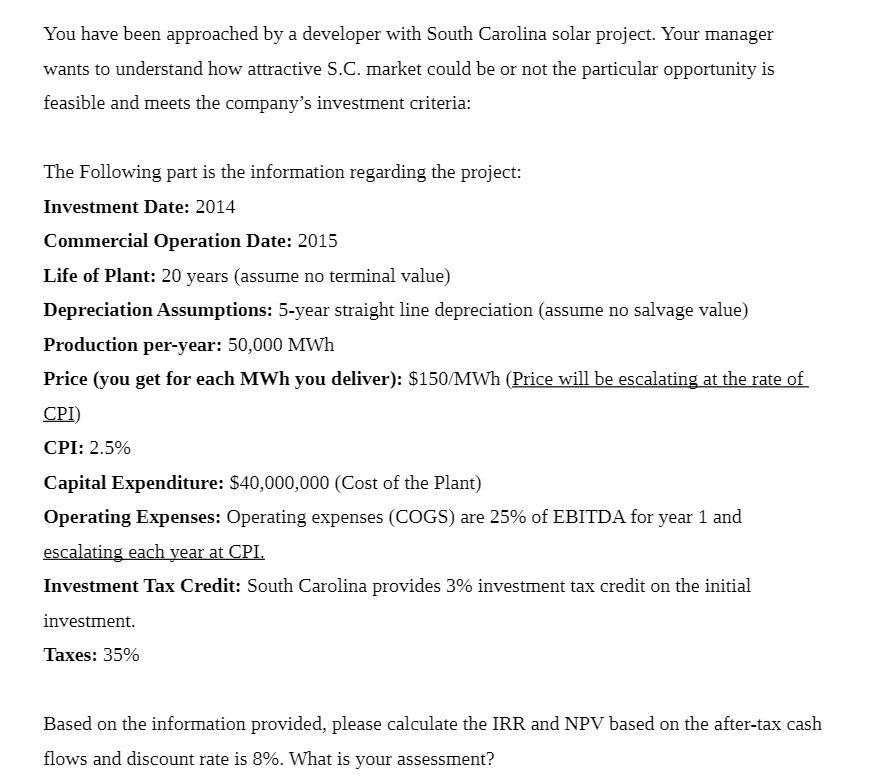

You have been approached by a developer with South Carolina solar project. Your manager wants to understand how attractive S.C. market could be or not the particular opportunity is feasible and meets the company's investment criteria: The Following part is the information regarding the project: Investment Date: 2014 Commercial Operation Date: 2015 Life of Plant: 20 years (assume no terminal value) Depreciation Assumptions: 5-year straight line depreciation (assume no salvage value) Production per-year: 50,000 MWh Price (you get for each MWh you deliver): $150/MWh (Price will be escalating at the rate of CPI) CPI: 2.5% Capital Expenditure: $40,000,000 (Cost of the Plant) Operating Expenses: Operating expenses (COGS) are 25% of EBITDA for year 1 and escalating each year at CPI. Investment Tax Credit: South Carolina provides 3% investment tax credit on the initial investment. Taxes: 35% Based on the information provided, please calculate the IRR and NPV based on the after-tax cash flows and discount rate is 8%. What is your assessment?

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the IRR and NPV of the project we first need to calculate the aftertax cash fl... View full answer

Get step-by-step solutions from verified subject matter experts