Question: . You have been asked to develop a pro forma statement of cash flow for the coming (base) year for Summer Place Mall. The information

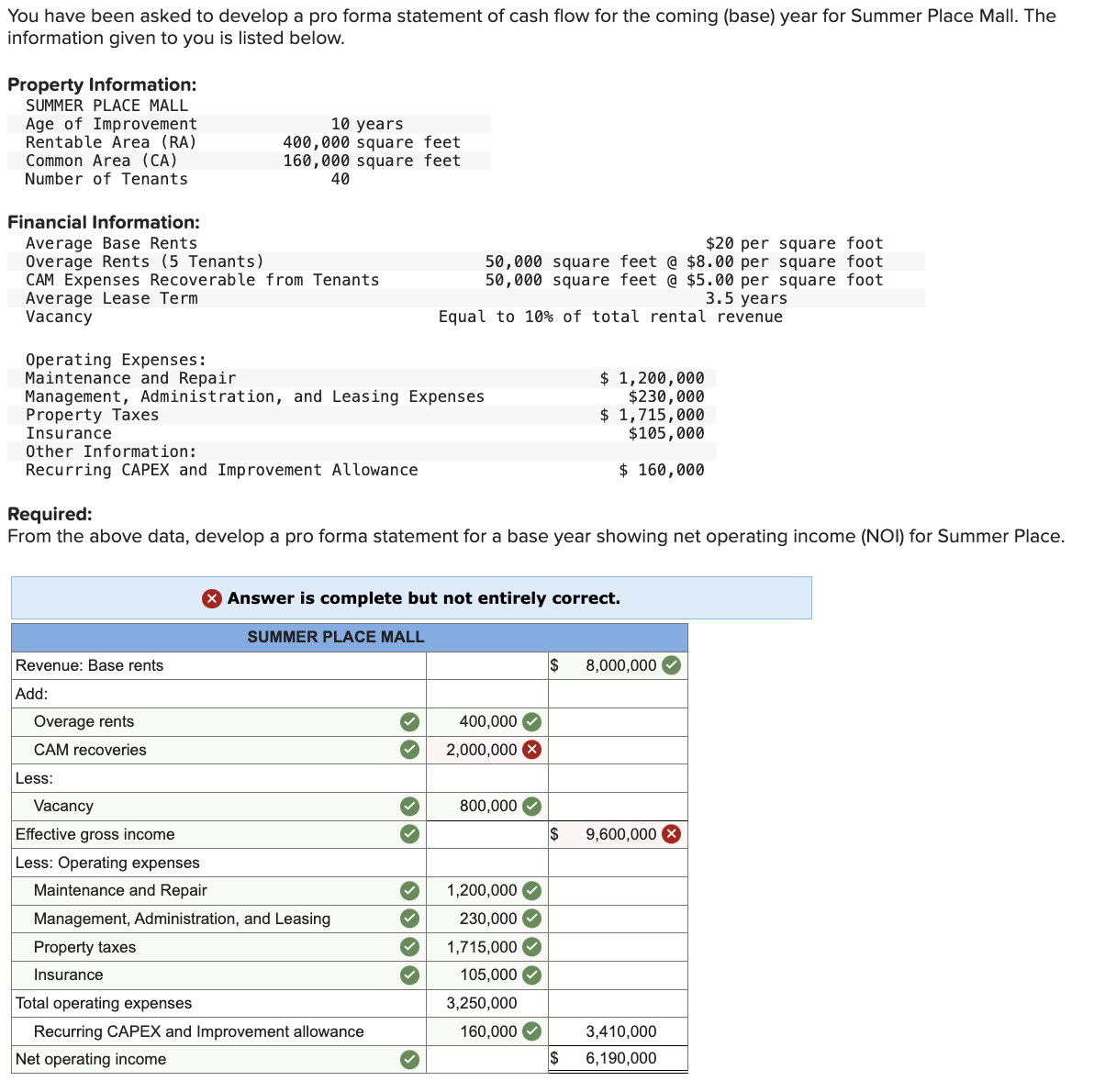

You have been asked to develop a pro forma statement of cash flow for the coming (base) year for Summer Place Mall. The information given to you is listed below. Property Information: SUMMER PLACE MALL Age of Improvement Rentable Area (RA) Common Area (CA) Number of Tenants 10 years 400,000 square feet 160,000 square feet 40 Financial Information: Average Base Rents Overage Rents (5 Tenants) CAM Expenses Recoverable from Tenants Average Lease Term Vacancy $20 per square foot 50,000 square feet @ $8.00 per square foot 50,000 square feet @ $5.00 per square foot 3.5 years Equal to 10% of total rental revenue Operating Expenses: Maintenance and Repair Management, Administration, and Leasing Expenses Property Taxes Insurance Other Information: Recurring CAPEX and Improvement Allowance Required: $ 1,200,000 $230,000 $ 1,715,000 $105,000 $ 160,000 From the above data, develop a pro forma statement for a base year showing net operating income (NOI) for Summer Place. > Answer is complete but not entirely correct. Revenue: Base rents Add: Overage rents CAM recoveries Less: Vacancy Effective gross income SUMMER PLACE MALL 400,000 2,000,000x $ 8,000,000 800,000 $ 9,600,000 Less: Operating expenses Maintenance and Repair 1,200,000 Management, Administration, and Leasing 230,000 Property taxes 1,715,000 Insurance 105,000 Total operating expenses 3,250,000 Recurring CAPEX and Improvement allowance 160,000 Net operating income 3,410,000 $ 6,190,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts