Question: You have been asked to develop an analytical database to analyze local and federal sales tax compared to value - added tax. An excerpt of

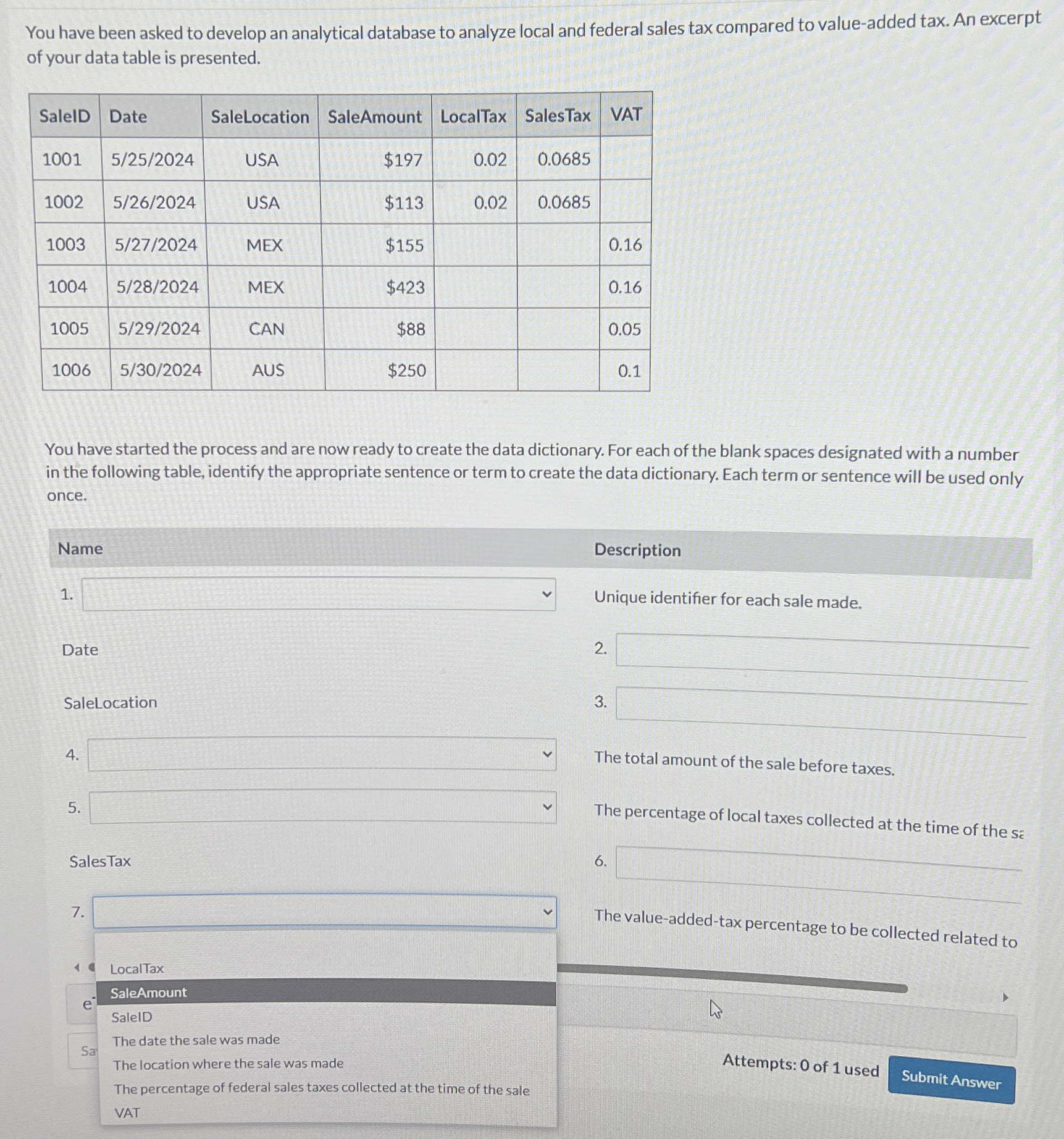

You have been asked to develop an analytical database to analyze local and federal sales tax compared to valueadded tax. An excerpt of your data table is presented.

tableSaleIDDate,SaleLocation,SaleAmount,LocalTax,SalesTax,VATUSA,$USA,$MEX,$MEX,$CAN,$AUS,$

You have started the process and are now ready to create the data dictionary. For each of the blank spaces designated with a number in the following table, identify the appropriate sentence or term to create the data dictionary. Each term or sentence will be used only once.

Name

Date

SaleLocation

SalesTax

LocalTax

SaleAmount

SaleID

Sa

The date the sale was made

The location where the sale was made

The percentage of federal sales taxes collected at the time of the sale VAT

Description

Unique identifier for each sale made.

The total amount of the sale before taxes.

The percentage of local taxes collected at the time of the si

The valueaddedtax percentage to be collected related to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock