Question: You have been asked to value Test Company using a discounted free cash flow to firm (unlevered free cash flow) approach. Your valuation date

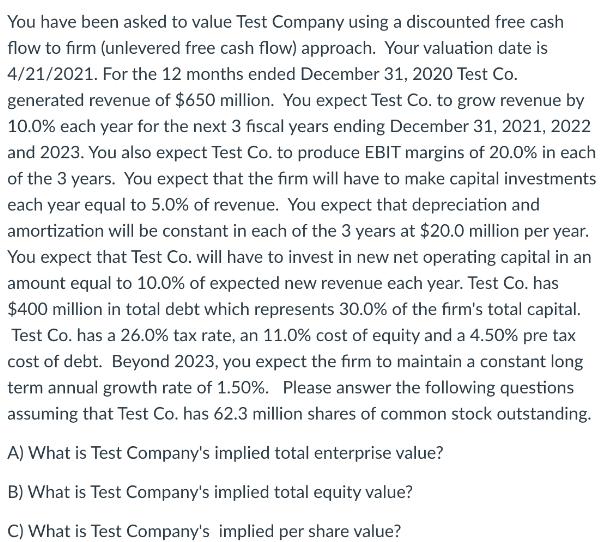

You have been asked to value Test Company using a discounted free cash flow to firm (unlevered free cash flow) approach. Your valuation date is 4/21/2021. For the 12 months ended December 31, 2020 Test Co. generated revenue of $650 million. You expect Test Co. to grow revenue by 10.0% each year for the next 3 fiscal years ending December 31, 2021, 2022 and 2023. You also expect Test Co. to produce EBIT margins of 20.0% in each of the 3 years. You expect that the firm will have to make capital investments each year equal to 5.0% of revenue. You expect that depreciation and amortization will be constant in each of the 3 years at $20.0 million per year. You expect that Test Co. will have to invest in new net operating capital in an amount equal to 10.0% of expected new revenue each year. Test Co. has $400 million in total debt which represents 30.0% of the firm's total capital. Test Co. has a 26.0% tax rate, an 11.0% cost of equity and a 4.50% pre tax cost of debt. Beyond 2023, you expect the firm to maintain a constant long term annual growth rate of 1.50%. Please answer the following questions assuming that Test Co. has 62.3 million shares of common stock outstanding. A) What is Test Company's implied total enterprise value? B) What is Test Company's implied total equity value? C) What is Test Company's implied per share value?

Step by Step Solution

There are 3 Steps involved in it

A To calculate Test Companys implied total enterprise value we need to discount the projected free c... View full answer

Get step-by-step solutions from verified subject matter experts