Question: . You have been given a choice between two retirement policies. Policy A: you will receive equal annual payments of $37,000 at the end of

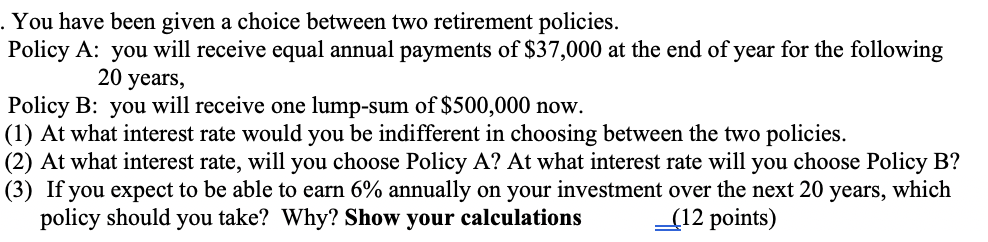

. You have been given a choice between two retirement policies. Policy A: you will receive equal annual payments of $37,000 at the end of year for the following 20 years, Policy B: you will receive one lump-sum of $500,000 now. (1) At what interest rate would you be indifferent in choosing between the two policies. (2) At what interest rate, will you choose Policy A? At what interest rate will you choose Policy B? (3) If you expect to be able to earn 6% annually on your investment over the next 20 years, which policy should you take? Why? Show your calculations _(12 points) . You have been given a choice between two retirement policies. Policy A: you will receive equal annual payments of $37,000 at the end of year for the following 20 years, Policy B: you will receive one lump-sum of $500,000 now. (1) At what interest rate would you be indifferent in choosing between the two policies. (2) At what interest rate, will you choose Policy A? At what interest rate will you choose Policy B? (3) If you expect to be able to earn 6% annually on your investment over the next 20 years, which policy should you take? Why? Show your calculations _(12 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts