Question: You have been given responsibility for overseeing a bank's small business loans division. The bank has Included loan covenants requiring a minimum current ratio

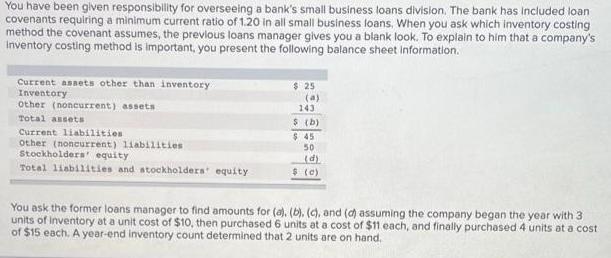

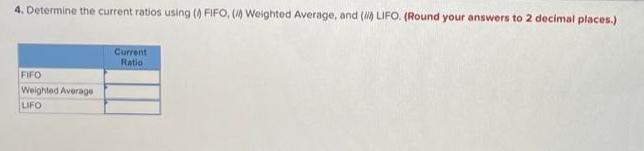

You have been given responsibility for overseeing a bank's small business loans division. The bank has Included loan covenants requiring a minimum current ratio of 1.20 in all small business loans, When you ask which inventory costing method the covenant assumes, the prevlous loans manager gives you a blank look. To explain to him that a company's Inventory costing method is important, you present the following balance sheet information. Current asaets other than inventory Inventory other (noncurrent) assets $ 25 (a) 143 Total assets $ (b) $ 45 50 Current liabilitien other (noncurrent) 1iabilities Stockholders' equity Total liabilities and stockholdera equity $ (e) You ask the former loans manager to find amounts for (a), (b), (4), and (d) assuming the company began the year with 3 units of inventory at a unit cost of $10, then purchased 6 units at a cost of $11 each, and finally purchased 4 units at a cost of $15 each. A year-end inventory count determined that 2 units are on hand. 4. Determine the current ratios using () FIFO, ( Weighted Average, and () LIFO. (Round your answers to 2 decimal places.) Current Ratio FIFO Weighted Average LIFO

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Solution Small Business Loans Division Calculation Req 1 Determine the amount for a usi... View full answer

Get step-by-step solutions from verified subject matter experts