Question: You have been given the following data on a competitor Define the term liquidity within a financial statement analysis context. What are the current and

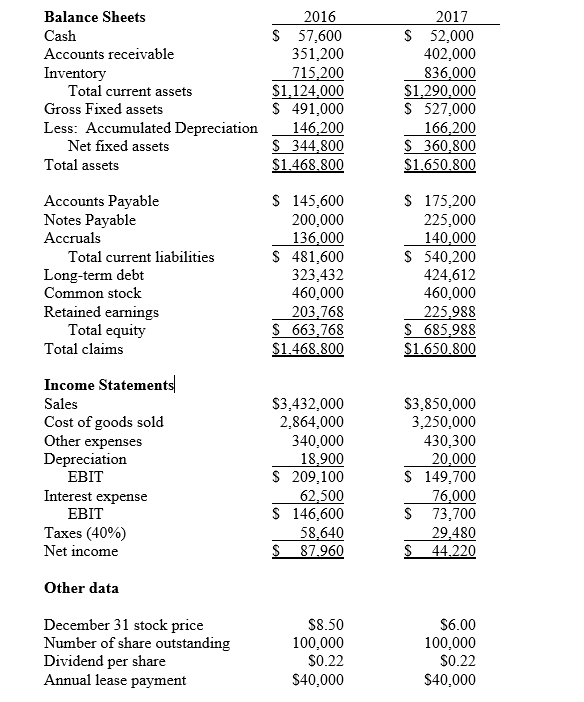

You have been given the following data on a competitor

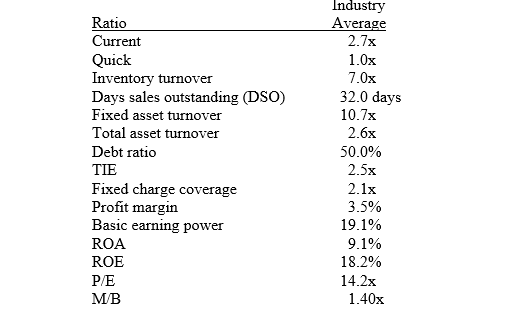

Define the term liquidity within a financial statement analysis context. What are the current and quick ratios? Assess the firms liquidity position.

What are the inventory turnover, days sales outstanding, fixed asset turnover, and total asset turnover? How do the firms asset utilization ratios stack up against the industry averages?

What are the debt, times-interest-earned, and fixed charge coverage ratios? How does it compare with the industry with respect to financial leverage?

Calculate the profitability ratios, that is, its profit margin, return on assets (ROA), return on equity (ROE).

What is common size analysis? Briefly describe how it an be applied to income statements and balance sheets. Does common size analysis replace ratio analysis, or should it be used to supplement ratio analysis?

2016 Balance Sheets Cash Accounts receivable Inventory 2017 S 57,600 351,200 715.200 S1,124,000 S 491,000 Less: Accumulated Depreciation 146,200 S 344,800 $1468 800 S 52,000 402,000 836.000 S1,290,000 S 527,000 166,200 S 360,800 Total current assets Gross Fixed assets Net fixed assets Total assets S 145,600 200,000 136,000 S 481,600 323,432 460,000 203,768 S663,768 175,200 225,000 140,000 S 540,200 424,612 460,000 225,988 S 685,988 Accounts Payable Notes Payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total equity Total claims Income Statement Sales Cost of goods sold Other expenses Depreciation S3.432,000 2,864,000 340,000 18,900 S 209,100 62.500 S 146,600 58.640 $3,850,000 3,250,000 430,300 20,000 S 149,700 76,000 S 73,700 29.480 EBIT Interest expense EBIT Taxes (40%) Net income Other data December 31 stock price Number of share outstanding Dividend per share Annual $8.50 100,000 S0.22 S40,000 $6.00 100,000 S0.22 S40,000 lease payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts