Question: You have been given two projects to evaluate for their investment potential. The estimates of the initial investment and incremental (relevant) after-tax cash flows associated

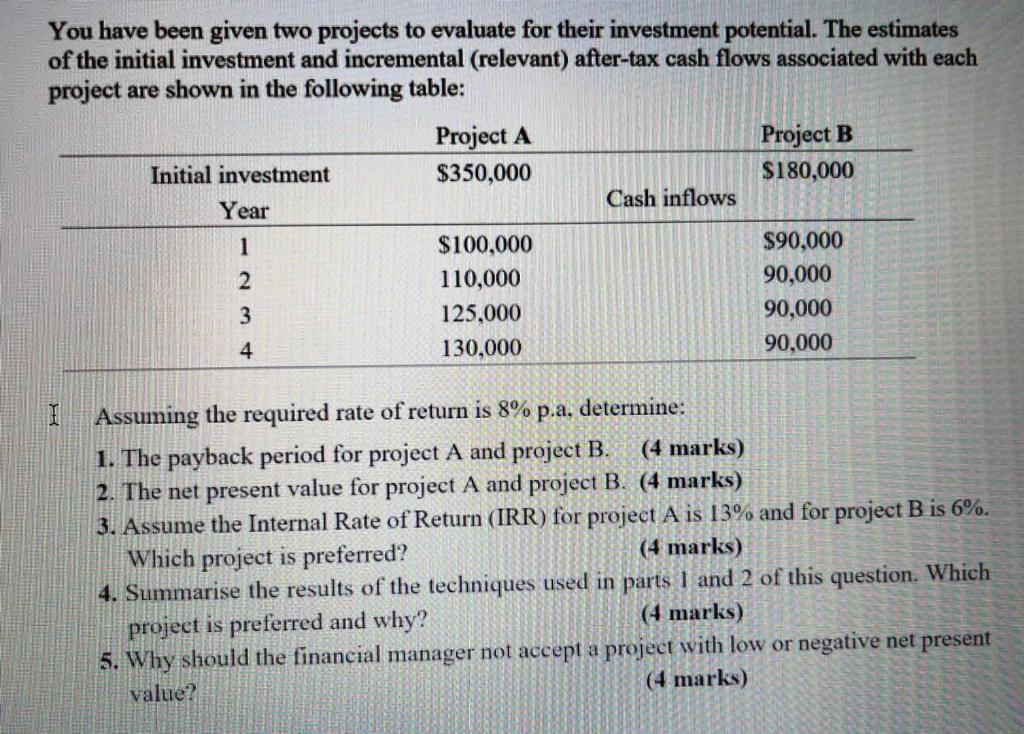

You have been given two projects to evaluate for their investment potential. The estimates of the initial investment and incremental (relevant) after-tax cash flows associated with each project are shown in the following table: Project A $350,000 Project B $180,000 Initial investment Cash inflows Year 1 $100,000 110,000 2 $90,000 90,000 90,000 90,000 3 125,000 4 130,000 Assuming the required rate of return is 8% p.a, determine: 1. The payback period for project A and project B. (4 marks) 2. The net present value for project A and project B. (4 marks) 3. Assume the Internal Rate of Return (IRR) for project A is 13% and for project B is 6%. Which project is preferred? (4 marks) 4. Summarise the results of the techniques used in parts 1 and 2 of this question. Which project is preferred and why? (4 marks) 5. Why should the financial manager not accept a project with low or negative net present value? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts