Question: You have been tasked with using the FCF model to value Julie's Jewelry Co. After your initial review, you find that Julie's has a reported

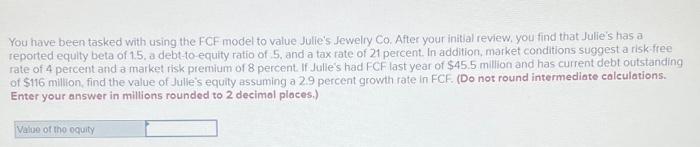

You have been tasked with using the FCF model to value Julie's Jewelry Co. After your initial review, you find that Julie's has a reported equity beta of 1.5 , a debt-to-equity ratio of 5 , and a tax rate of 21 percent. In addition, market conditions suggest a risk-free rate of 4 percent and a market risk premium of 8 percent. If Julle's had FCF last year of $45.5 million and has current debt outstanding of $116 million, find the value of Julle's equity assuming a 2.9 percent growth rate in FCF. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts