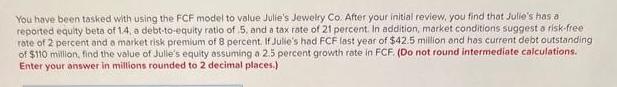

Question: You have been tasked with using the FCF model to value Julie's Jewelry Co. After your initial review, you find that Julie's has a

You have been tasked with using the FCF model to value Julie's Jewelry Co. After your initial review, you find that Julie's has a reported equity beta of 1.4, a debt-to-equity ratio of 5, and a tax rate of 21 percent. In addition, market conditions suggest a risk-free rate of 2 percent and a market risk premium of 8 percent. If Julie's had FCF last year of $42.5 million and has current debt outstanding of $110 million, find the value of Julie's equity assuming a 2.5 percent growth rate in FCF. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

The task is to use the Free Cash Flow to Equity FCFE model to value Julies Jewelry Co Lets step through the solution First we need to calculate the co... View full answer

Get step-by-step solutions from verified subject matter experts