Question: You have bid for a possible export order that would provide a cash inflow of 1 million in 6 months. The spot exchange rate is

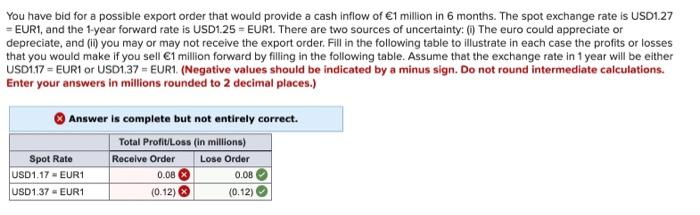

You have bid for a possible export order that would provide a cash inflow of 1 million in 6 months. The spot exchange rate is USD1.27 = EUR1, and the 1-year forward rate is USD1.25 = EUR1. There are two sources of uncertainty: 0 The euro could appreciate or depreciate, and (10 you may or may not receive the export order. Fill in the following table to illustrate in each case the profits or losses that you would make if you sell 1 million forward by filling in the following table. Assume that the exchange rate in 1 year will be either USD1.17 = EURI or USD1.37 = EUR1. (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Answer is complete but not entirely correct. Total Profit/Loss (in millions) Spot Rate Receive Order Lose Order USD1.17 = EUR1 0.08 0.08 USD1.37 - EUR1 (0.12) (0.12)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts