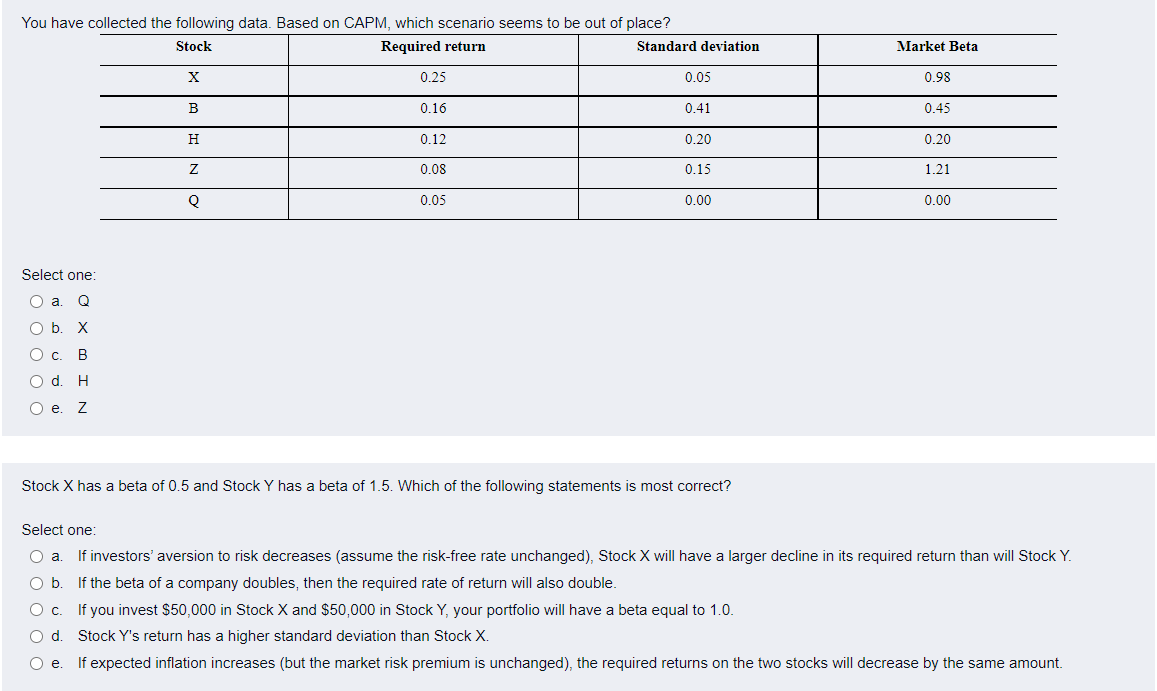

Question: You have collected the following data. Based on CAPM, which scenario seems to be out of place? Stock Required return Standard deviation Market Beta X

You have collected the following data. Based on CAPM, which scenario seems to be out of place? Stock Required return Standard deviation Market Beta X 0.25 0.05 0.98 B 0.16 0.41 0.45 H 0.12 0.20 0.20 Z 0.08 0.15 1.21 Q 0.05 0.00 0.00 Select one: O a. Q O b. X . Od. H Oe. Z Stock X has a beta of 0.5 and Stock Y has a beta of 1.5. Which of the following statements is most correct? Select one: O a. If investors' aversion to risk decreases (assume the risk-free rate unchanged), Stock X will have a larger decline in its required return than will Stock Y. Ob If the beta of a company doubles, then the required rate of return will also double. O c. If you invest $50,000 in Stock X and $50,000 in Stock Y, your portfolio will have a beta equal to 1.0. Od Stock Y's return has a higher standard deviation than Stock X. Oe. If expected inflation increases (but the market risk premium is unchanged), the required returns on the two stocks will decrease by the same amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts