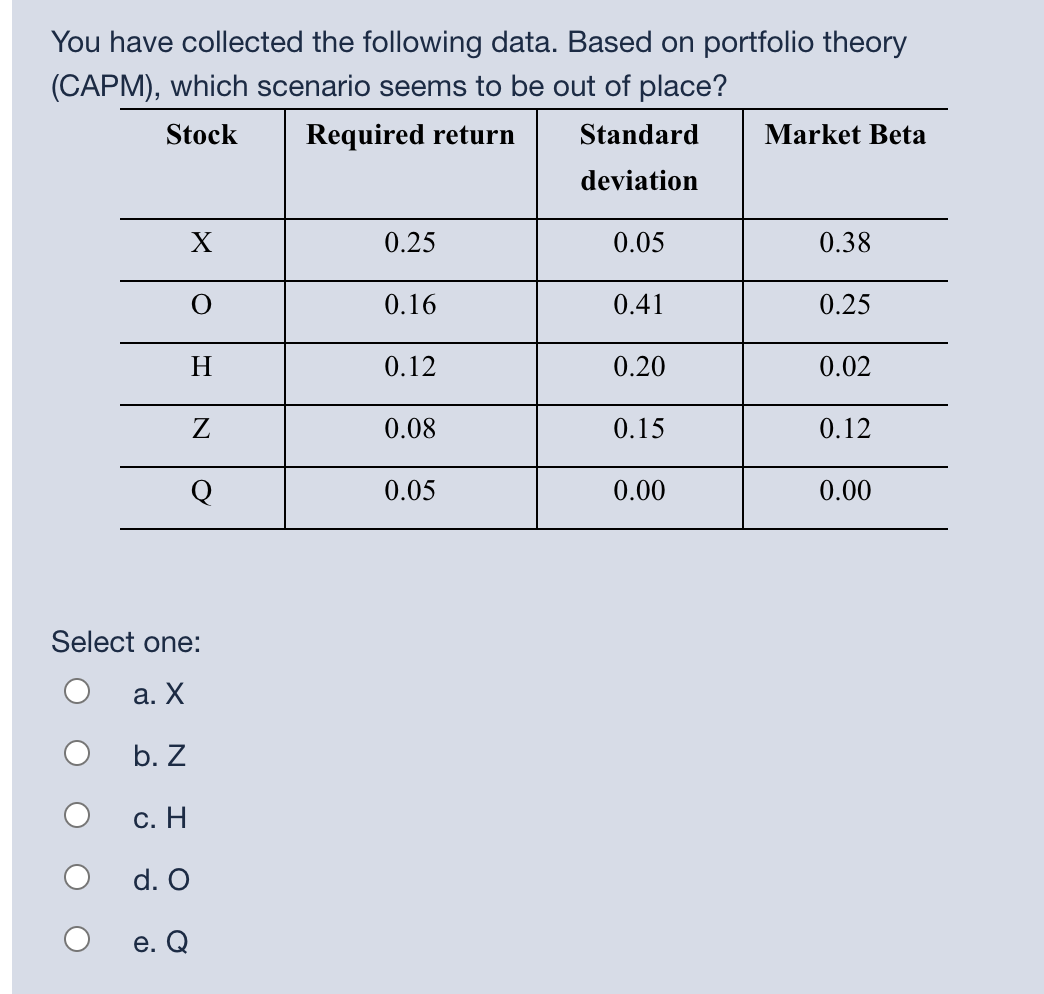

Question: You have collected the following data. Based on portfolio theory (CAPM), which scenario seems to be out of place? Stock Required return Standard Market Beta

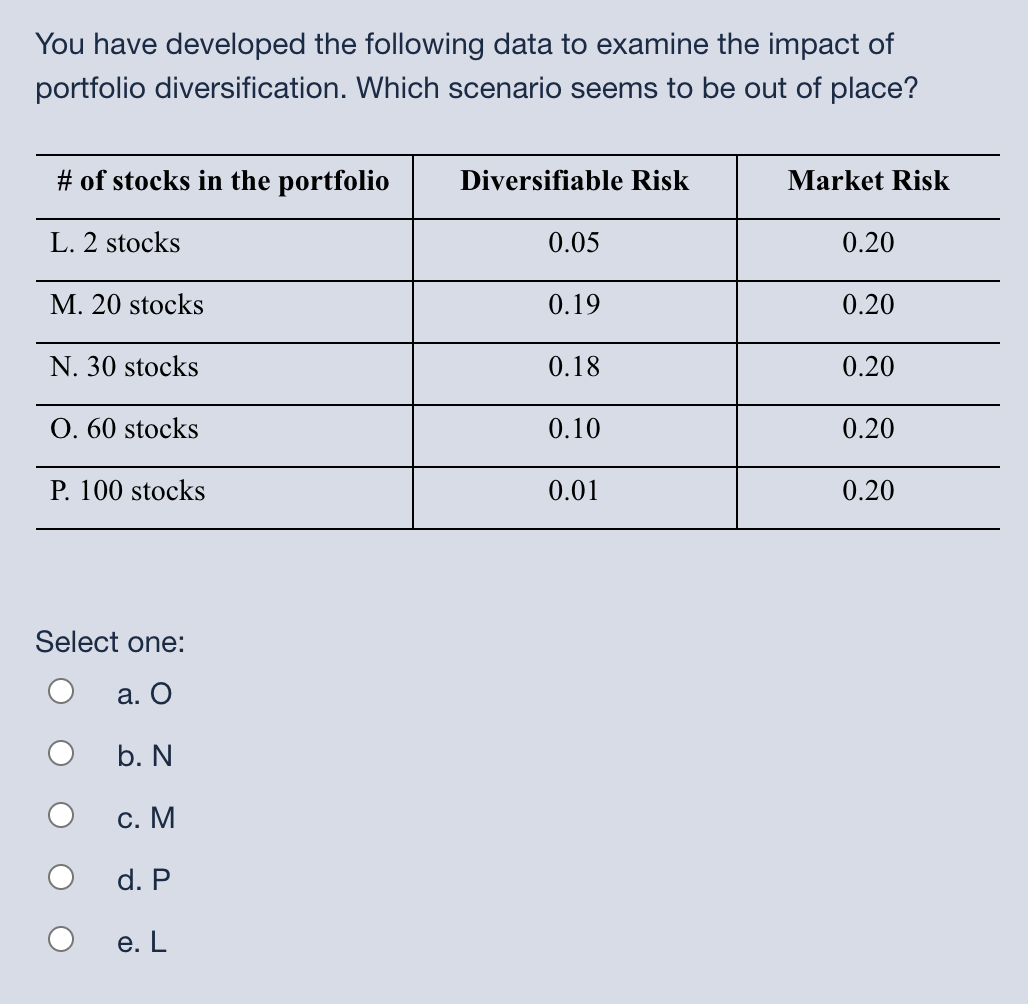

You have collected the following data. Based on portfolio theory (CAPM), which scenario seems to be out of place? Stock Required return Standard Market Beta deviation X 0.25 0.05 0.38 O 0.16 0.41 0.25 H 0.12 0.20 0.02 Z 0.08 0.15 0.12 Q 0.05 0.00 0.00 Select one: a. X O b. Z c. H d. O e. Q You have developed the following data to examine the impact of portfolio diversification. Which scenario seems to be out of place? # of stocks in the portfolio Diversifiable Risk Market Risk L. 2 stocks 0.05 0.20 M. 20 stocks 0.19 0.20 N. 30 stocks 0.18 0.20 0. 60 stocks 0.10 0.20 P. 100 stocks 0.01 0.20 Select one: a. O O b. N. c. M d. P e. L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts